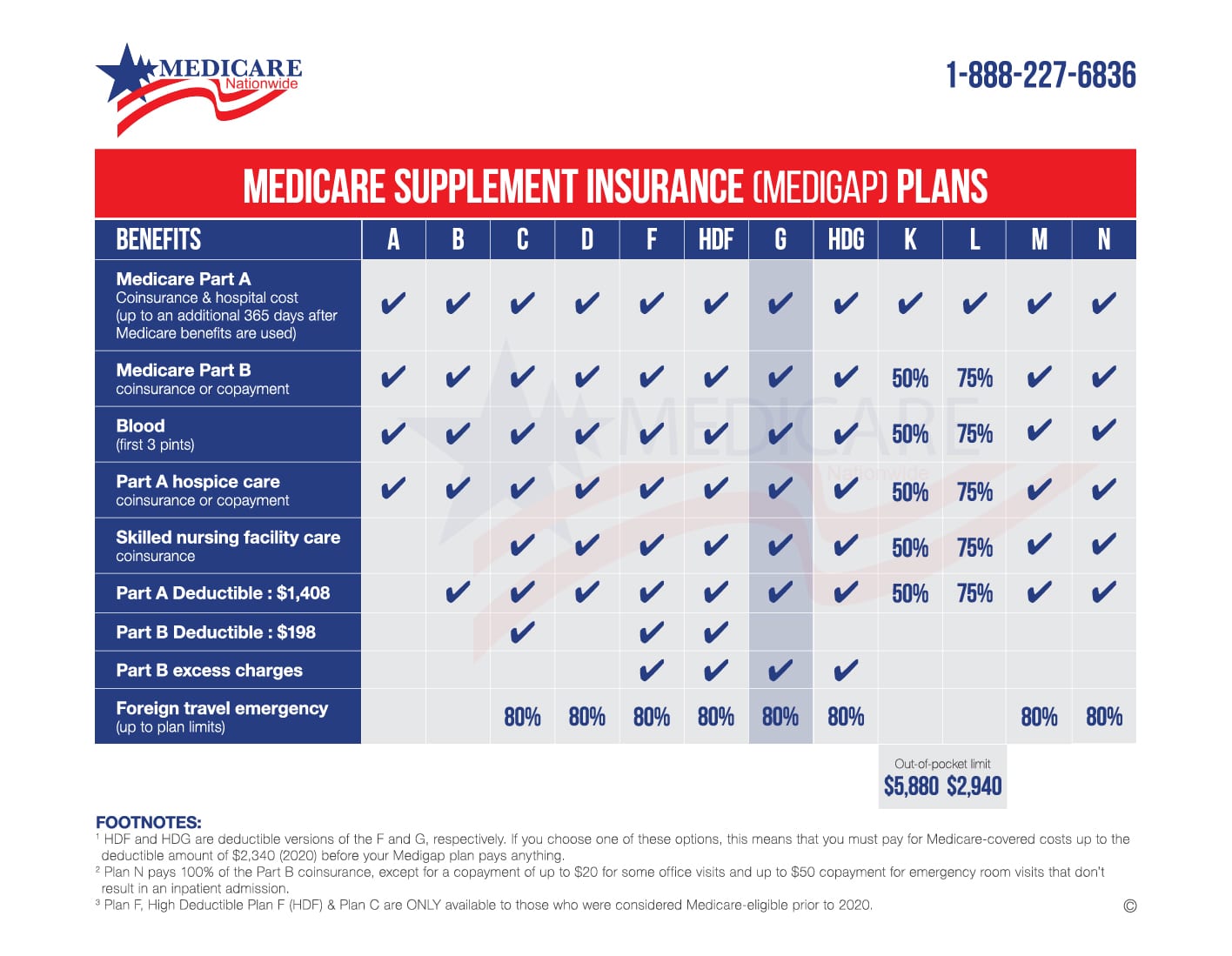

Mi Coverage Chart

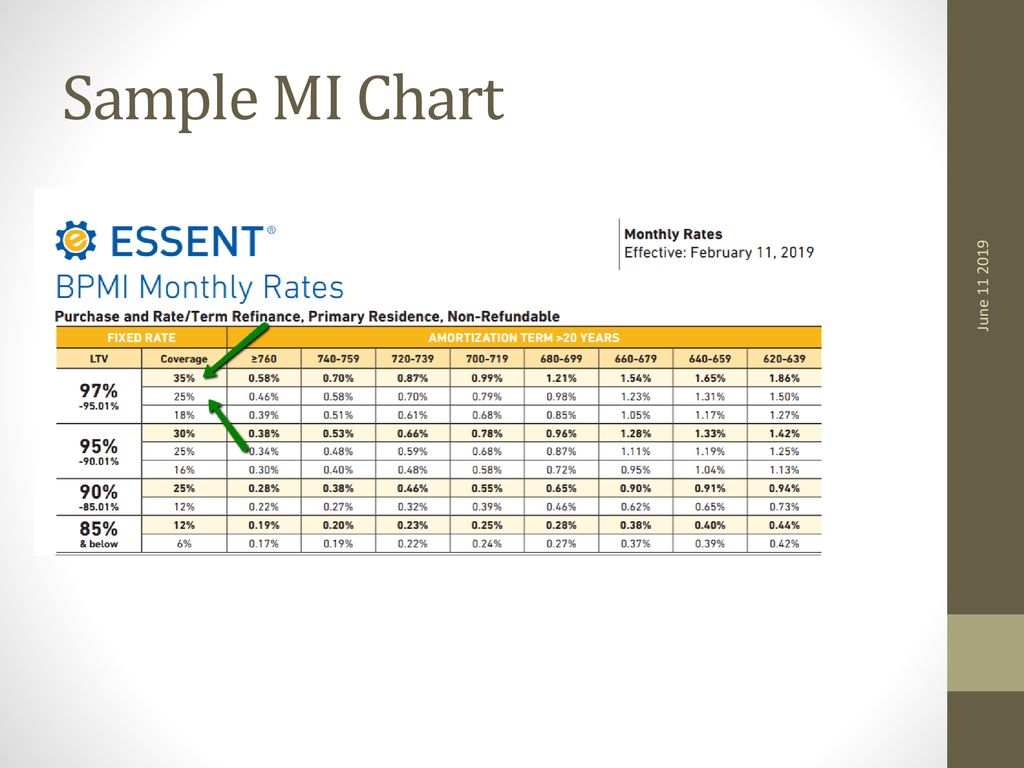

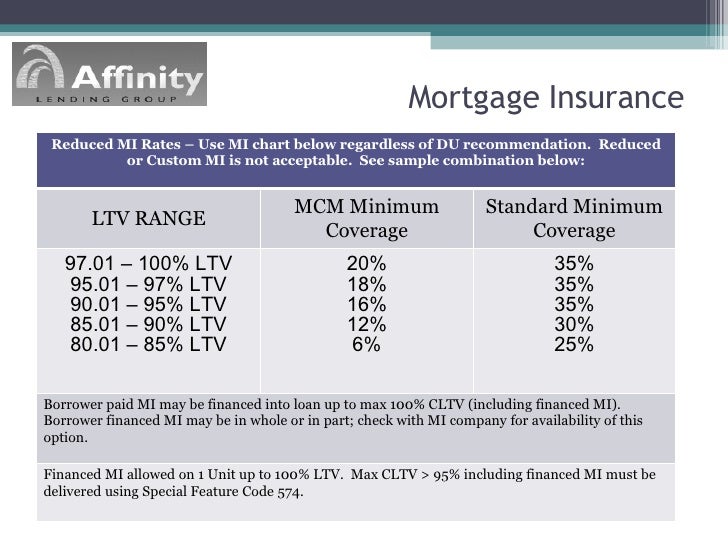

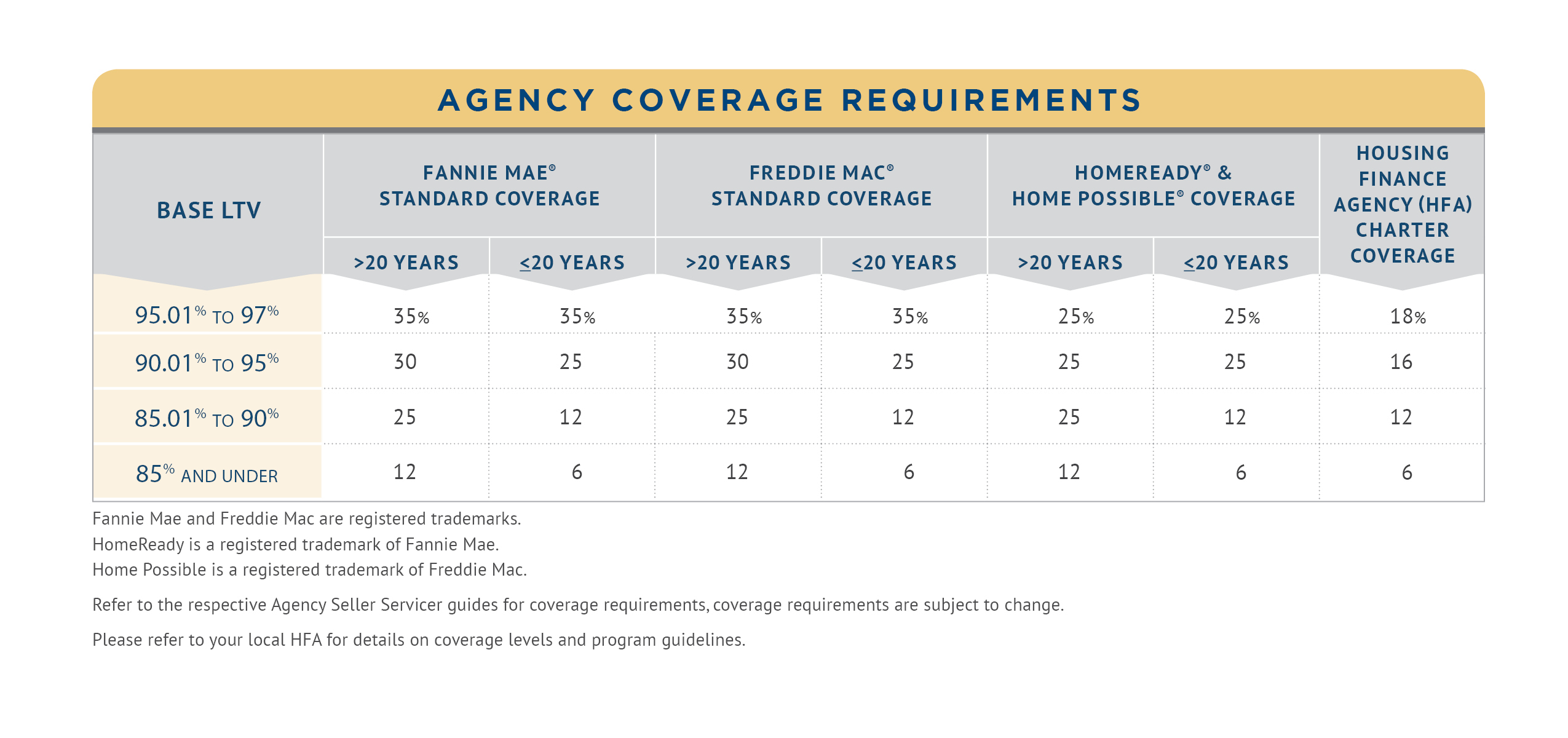

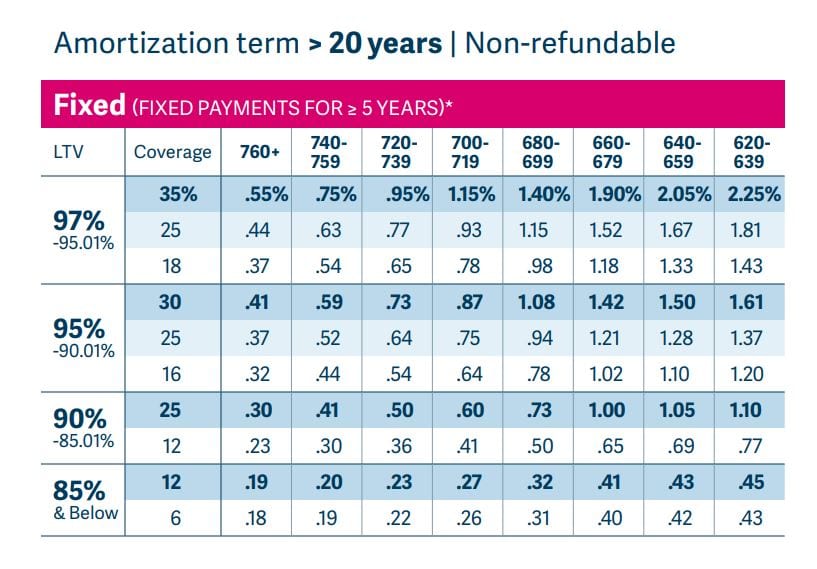

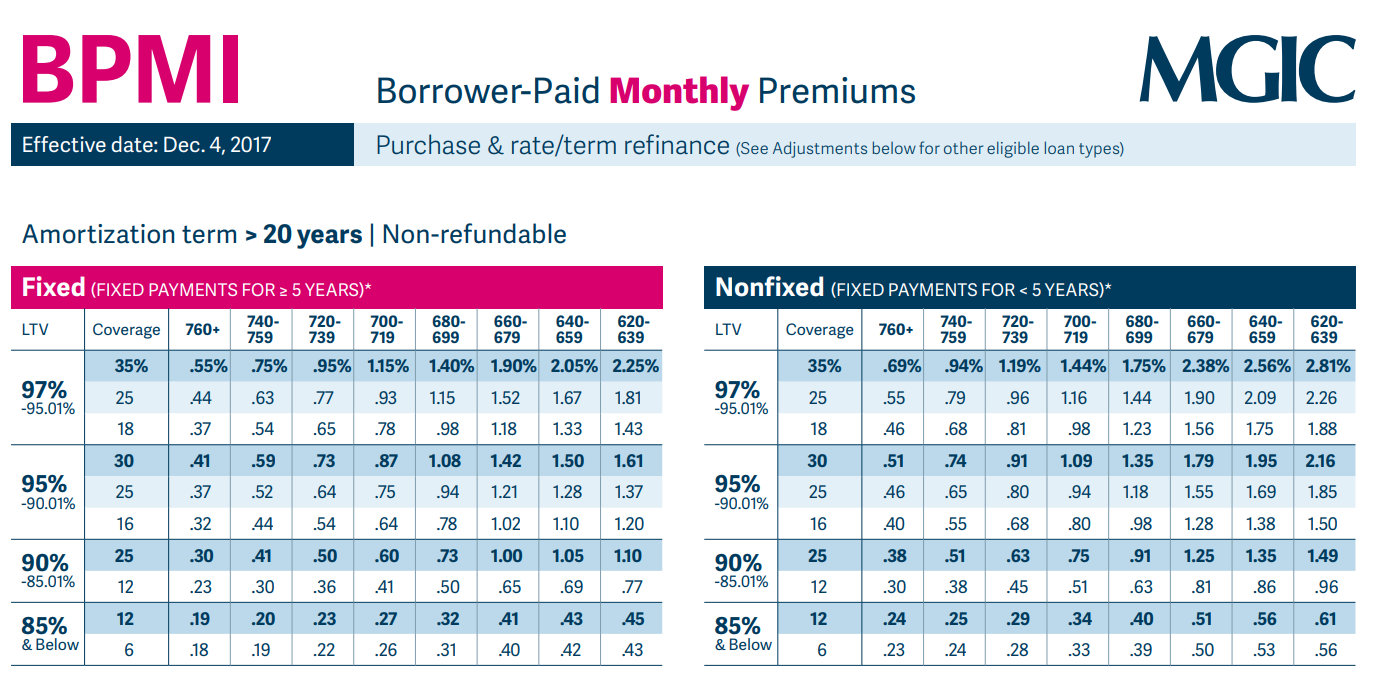

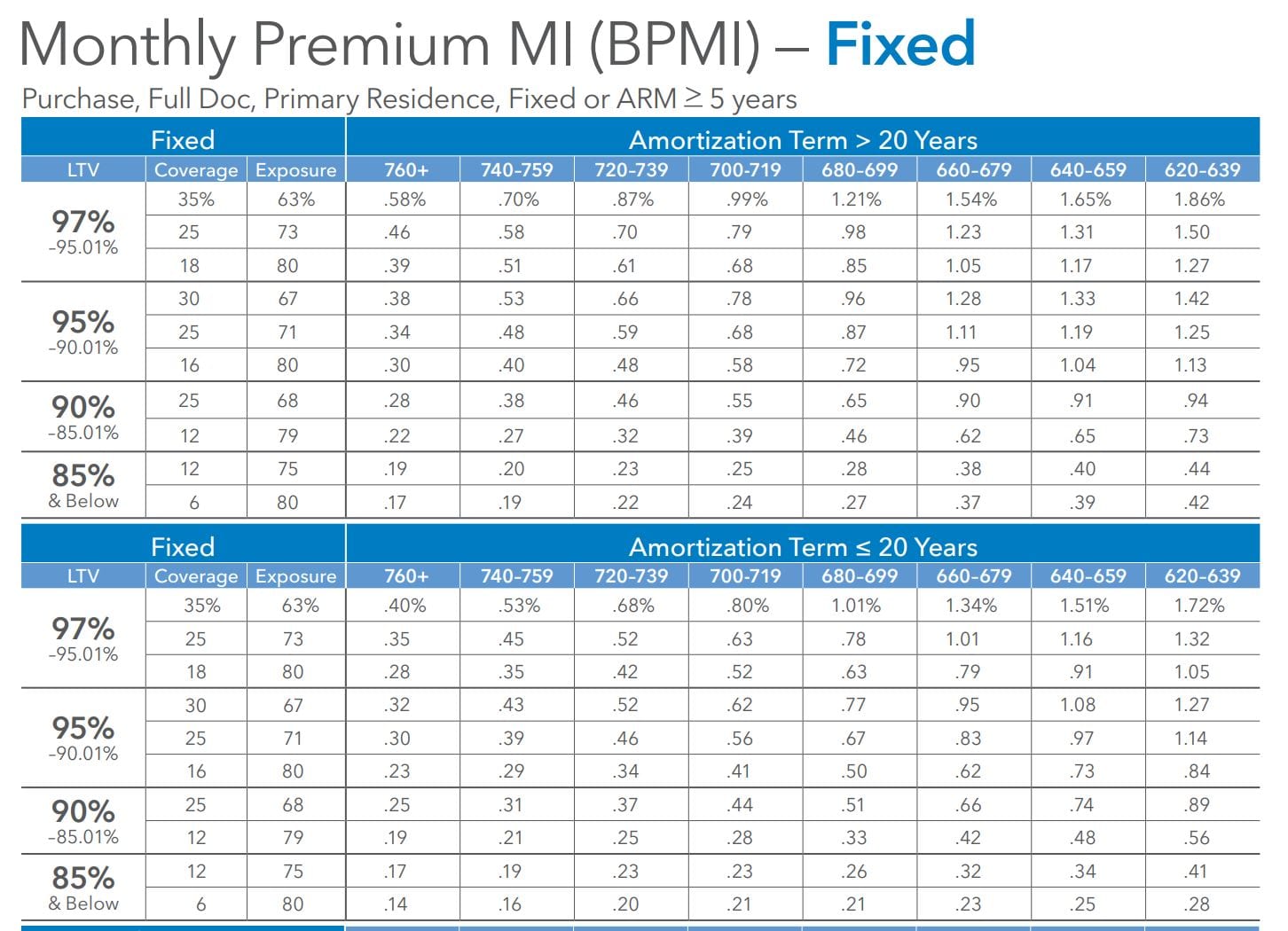

Mi Coverage Chart - Depending on the loan, fannie mae, freddie mac and investors require different levels of coverage for mortgage insurance (mi). There may be more coverage offerings. Determine your level of exposure. Mi may be financed up to the maximum ltv for the transaction, including the financed mi (minimum mi coverage option may be used with additional llpa; We offer competitive mi rates and loan products, as well as greater flexibility in how you work with us. The table below provides the mortgage insurance coverage requirements for first lien mortgages. Check out our standard mi rates and guidelines. Fannie mae and freddie mac offer a variety of coverage options. The table below highlights their standard coverage. The table below details the standard coverage requirements. The table below highlights their standard coverage. Mgic offers mortgage insurance premium plans to meet your borrower’s unique homebuying needs. Check out our standard mi rates and guidelines. For certain transactions, the gses offer two mortgage insurance coverage level options:. There may be more coverage offerings. Mi may be financed up to the maximum ltv for the transaction, including the financed mi (minimum mi coverage option may be used with additional llpa; The table below provides the mortgage insurance coverage requirements for first lien mortgages. Standard coverage for the transaction type (noted with ^) and minimum coverage. We offer competitive mi rates and loan products, as well as greater flexibility in how you work with us. Fannie mae and freddie mac offer a variety of coverage options. For certain transactions, fannie mae offers two mortgage insurance coverage level options: Look up fannie, freddie standard and special program mortgage insurance coverage requirements; The table below highlights their standard coverage. The table below details the standard coverage requirements. Mgic offers mortgage insurance premium plans to meet your borrower’s unique homebuying needs. There may be more coverage offerings. The table below highlights their standard coverage. Mgic offers mortgage insurance premium plans to meet your borrower’s unique homebuying needs. Determine your level of exposure. Fannie mae and freddie mac offer a variety of coverage options. The table below provides the mortgage insurance coverage requirements for first lien mortgages. For certain transactions, fannie mae offers two mortgage insurance coverage level options: Mgic offers mortgage insurance premium plans to meet your borrower’s unique homebuying needs. Mi may be financed up to the maximum ltv for the transaction, including the financed mi (minimum mi coverage option may be. Depending on the loan, fannie mae, freddie mac and investors require different levels of coverage for mortgage insurance (mi). Look up fannie, freddie standard and special program mortgage insurance coverage requirements; Mi may be financed up to the maximum ltv for the transaction, including the financed mi (minimum mi coverage option may be used with additional llpa; Mgic offers mortgage. For certain transactions, fannie mae offers two mortgage insurance coverage level options: Depending on the loan, fannie mae, freddie mac and investors require different levels of coverage for mortgage insurance (mi). The table below provides the mortgage insurance coverage requirements for first lien mortgages. Determine your level of exposure. Fannie mae and freddie mac offer a variety of coverage options. Fannie mae and freddie mac offer a variety of coverage options. There may be more coverage offerings. For certain transactions, the gses offer two mortgage insurance coverage level options:. Mi may be financed up to the maximum ltv for the transaction, including the financed mi (minimum mi coverage option may be used with additional llpa; The table below provides the. The table below details the standard coverage requirements. The table below provides the mortgage insurance coverage requirements for first lien mortgages. We offer competitive mi rates and loan products, as well as greater flexibility in how you work with us. The table below highlights their standard coverage. Depending on the loan, fannie mae, freddie mac and investors require different levels. The table below details the standard coverage requirements. We offer competitive mi rates and loan products, as well as greater flexibility in how you work with us. For certain transactions, fannie mae offers two mortgage insurance coverage level options: There may be more coverage offerings. For certain transactions, the gses offer two mortgage insurance coverage level options:. For certain transactions, fannie mae offers two mortgage insurance coverage level options: Fannie mae and freddie mac offer a variety of coverage options. Depending on the loan, fannie mae, freddie mac and investors require different levels of coverage for mortgage insurance (mi). We offer competitive mi rates and loan products, as well as greater flexibility in how you work with. The table below details the standard coverage requirements. Depending on the loan, fannie mae, freddie mac and investors require different levels of coverage for mortgage insurance (mi). Standard coverage for the transaction type (noted with ^) and minimum coverage. For certain transactions, the gses offer two mortgage insurance coverage level options:. There may be more coverage offerings. For certain transactions, the gses offer two mortgage insurance coverage level options:. Look up fannie, freddie standard and special program mortgage insurance coverage requirements; The table below details the standard coverage requirements. The table below provides the mortgage insurance coverage requirements for first lien mortgages. Standard coverage for the transaction type (noted with ^) and minimum coverage. Fannie mae and freddie mac offer a variety of coverage options. Mgic offers mortgage insurance premium plans to meet your borrower’s unique homebuying needs. Determine your level of exposure. Mi may be financed up to the maximum ltv for the transaction, including the financed mi (minimum mi coverage option may be used with additional llpa; We offer competitive mi rates and loan products, as well as greater flexibility in how you work with us. For certain transactions, fannie mae offers two mortgage insurance coverage level options: There may be more coverage offerings.Mi Coverage Chart Portal.posgradount.edu.pe

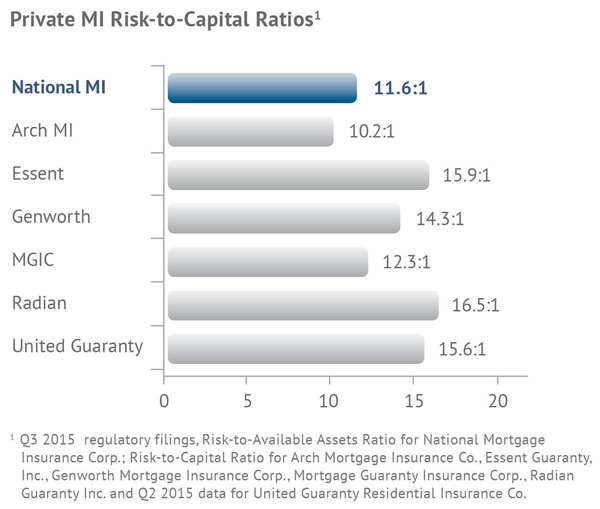

THE CONVENTIONAL ADVANTAGE ppt download

My Community Mortgage & Flexible Mortgage Ppt

National MI's Products and Rates National MI

PMIERs National MI

What is mortgage insurance? Mortgage Rates, Mortgage News and Strategy The Mortgage Reports

Private Mortgage Insurance Friend or Foe?

PMI mistakes to avoid How to pay less for mortgage insurance Mortgage Rates, Mortgage News

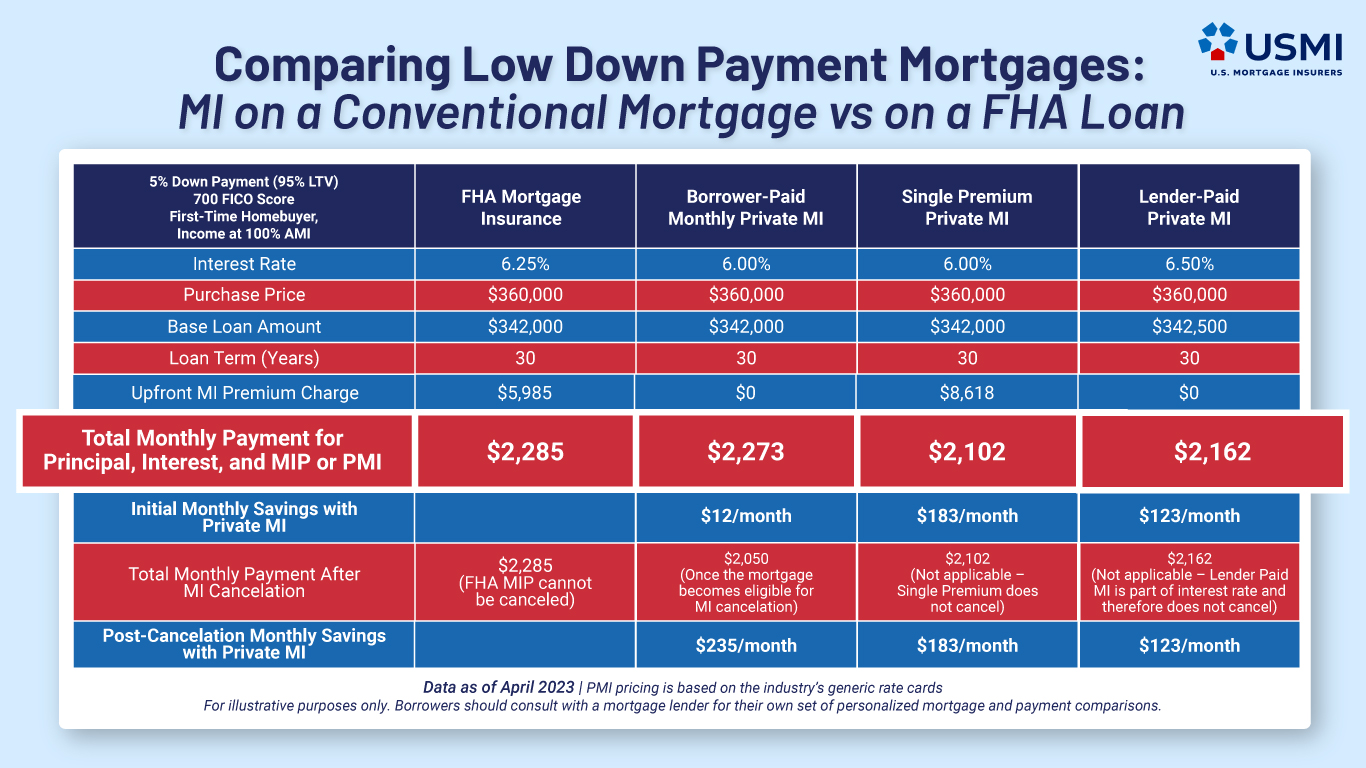

Understanding Private Mortgage Insurance Options USMI

Annual Mortgage Insurance Premium on FHA Loans Reduced 30 Basis Points The Truth About Mortgage

Depending On The Loan, Fannie Mae, Freddie Mac And Investors Require Different Levels Of Coverage For Mortgage Insurance (Mi).

The Table Below Highlights Their Standard Coverage.

Check Out Our Standard Mi Rates And Guidelines.

Related Post: