Valuation Chart

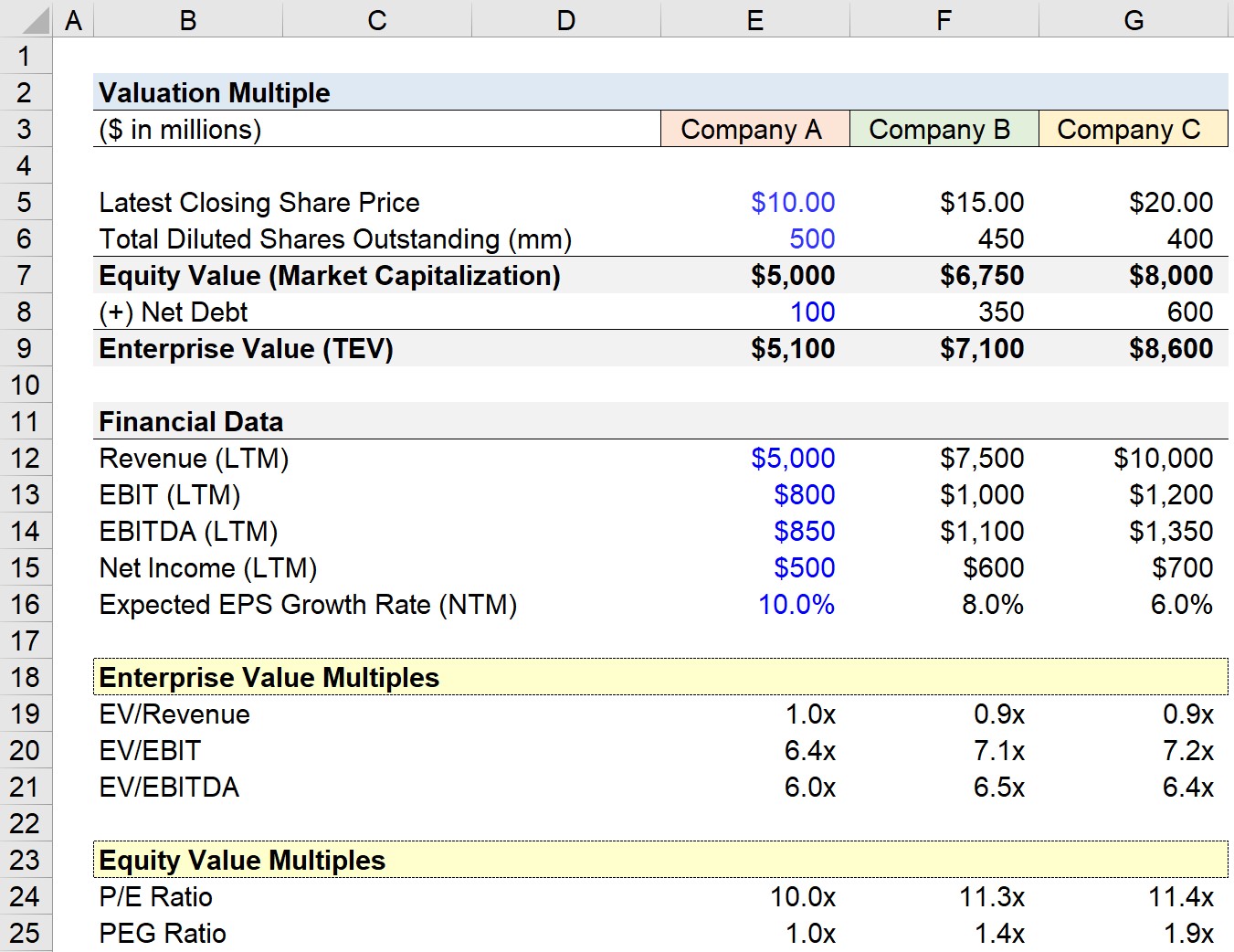

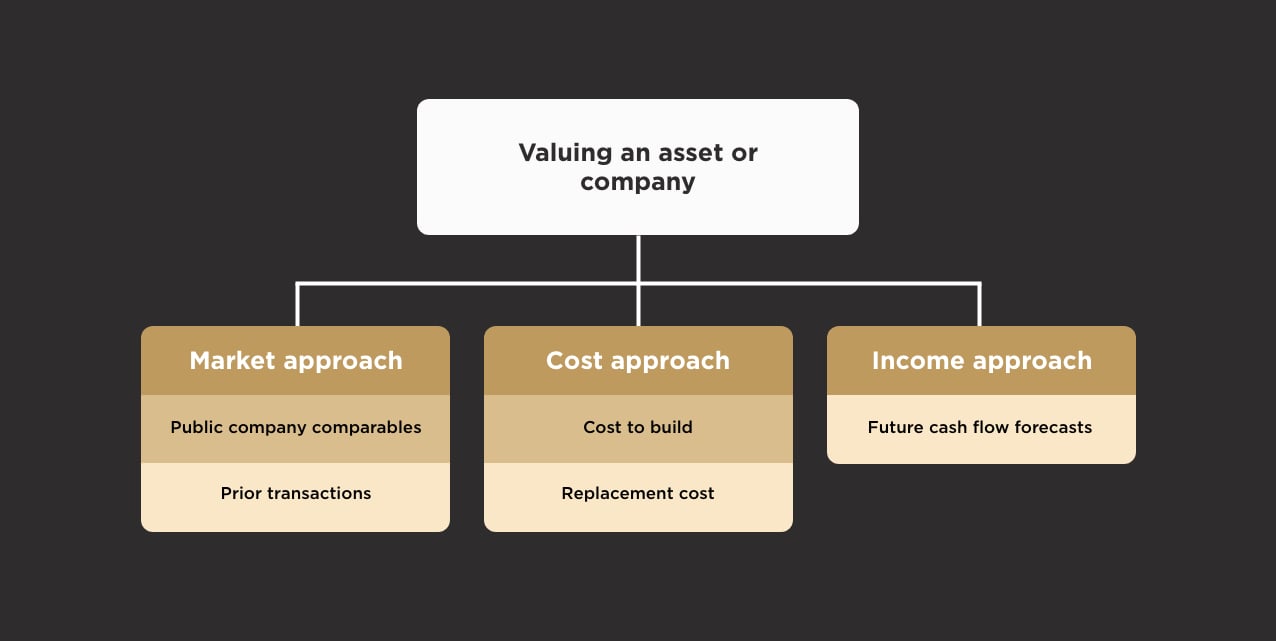

Valuation Chart - Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value, divorce litigation, and. Below are three major valuation methods that are. Thus, valuation is an important part of mergers and acquisitions (m&a), as it guides the buyer and seller to reach the final transaction price. The ebitda multiple is a financial ratio that compares a company's enterprise value to its annual ebitda. Explore cfi's valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth. Fmva® program overview cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective financial models for. Explore expert valuation resources to build a stronger understanding of core concepts and techniques. Find out how to take the next step in your learning journey. Explore expert valuation resources to build a stronger understanding of core concepts and techniques. Explore cfi's valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth. Thus, valuation is an important part of mergers and acquisitions (m&a), as it guides the buyer and seller to reach the final transaction price. Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value, divorce litigation, and. The ebitda multiple is a financial ratio that compares a company's enterprise value to its annual ebitda. Find out how to take the next step in your learning journey. Fmva® program overview cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective financial models for. Below are three major valuation methods that are. Below are three major valuation methods that are. Thus, valuation is an important part of mergers and acquisitions (m&a), as it guides the buyer and seller to reach the final transaction price. Find out how to take the next step in your learning journey. Explore cfi's valuation courses to find expert insights and learn about different methods and tools to. Find out how to take the next step in your learning journey. Explore cfi's valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth. Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value, divorce litigation, and.. Find out how to take the next step in your learning journey. The ebitda multiple is a financial ratio that compares a company's enterprise value to its annual ebitda. Explore cfi's valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth. Fmva® program overview cfi's financial modeling & valuation. The ebitda multiple is a financial ratio that compares a company's enterprise value to its annual ebitda. Thus, valuation is an important part of mergers and acquisitions (m&a), as it guides the buyer and seller to reach the final transaction price. Fmva® program overview cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective. Thus, valuation is an important part of mergers and acquisitions (m&a), as it guides the buyer and seller to reach the final transaction price. Find out how to take the next step in your learning journey. The ebitda multiple is a financial ratio that compares a company's enterprise value to its annual ebitda. Below are three major valuation methods that. Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value, divorce litigation, and. Thus, valuation is an important part of mergers and acquisitions (m&a), as it guides the buyer and seller to reach the final transaction price. Find out how to take the next step in your learning. Below are three major valuation methods that are. Fmva® program overview cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective financial models for. Thus, valuation is an important part of mergers and acquisitions (m&a), as it guides the buyer and seller to reach the final transaction price. Explore cfi's valuation courses to find. Fmva® program overview cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective financial models for. The ebitda multiple is a financial ratio that compares a company's enterprise value to its annual ebitda. Below are three major valuation methods that are. Thus, valuation is an important part of mergers and acquisitions (m&a), as it. Explore cfi's valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth. Fmva® program overview cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective financial models for. Explore expert valuation resources to build a stronger understanding of core concepts and techniques. Below. Explore expert valuation resources to build a stronger understanding of core concepts and techniques. Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value, divorce litigation, and. Fmva® program overview cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective financial models. Thus, valuation is an important part of mergers and acquisitions (m&a), as it guides the buyer and seller to reach the final transaction price. The ebitda multiple is a financial ratio that compares a company's enterprise value to its annual ebitda. Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value, divorce litigation, and. Fmva® program overview cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective financial models for. Find out how to take the next step in your learning journey. Explore cfi's valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth.PreMoney vs. PostMoney Valuations How to Calculate Each

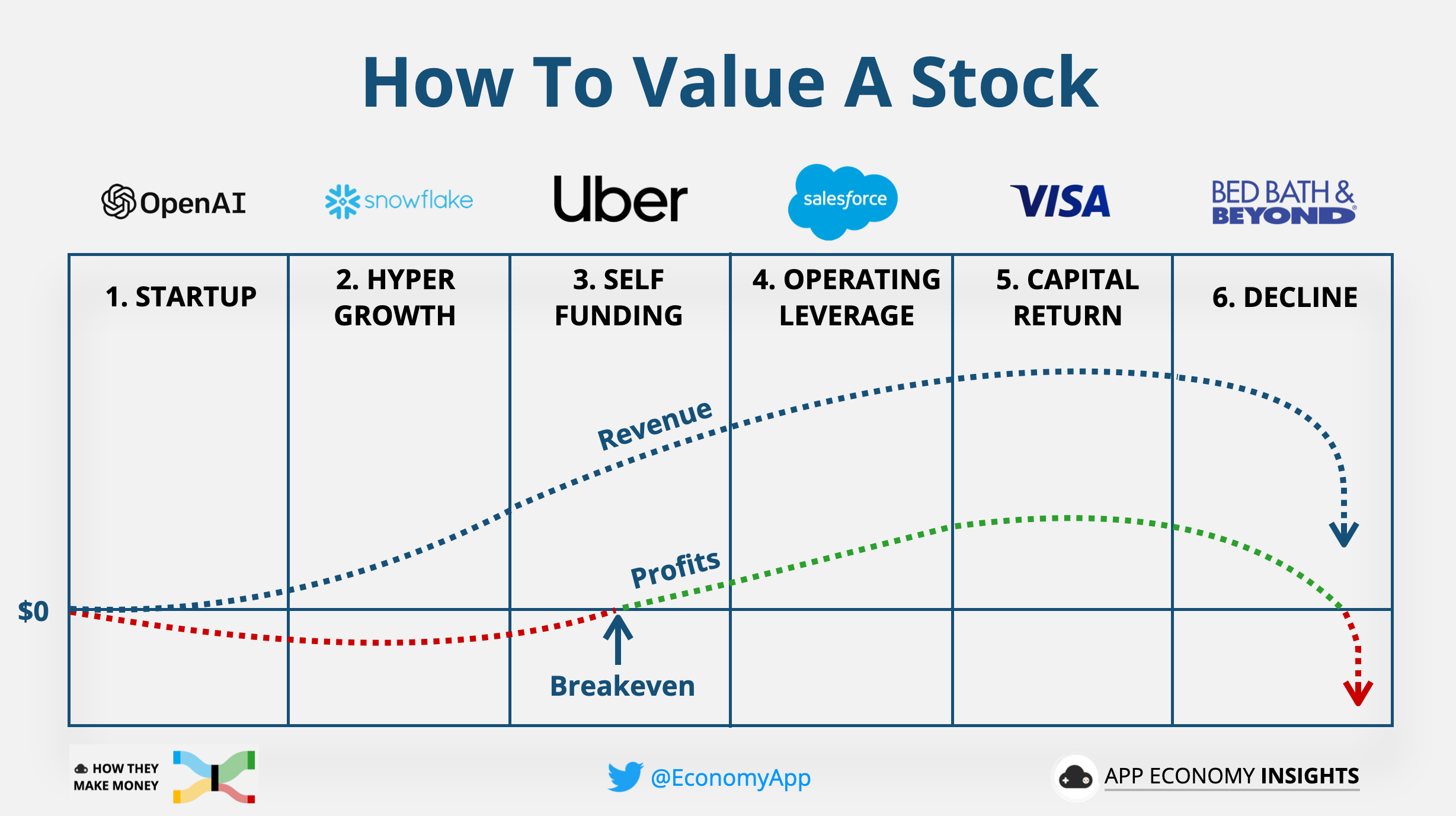

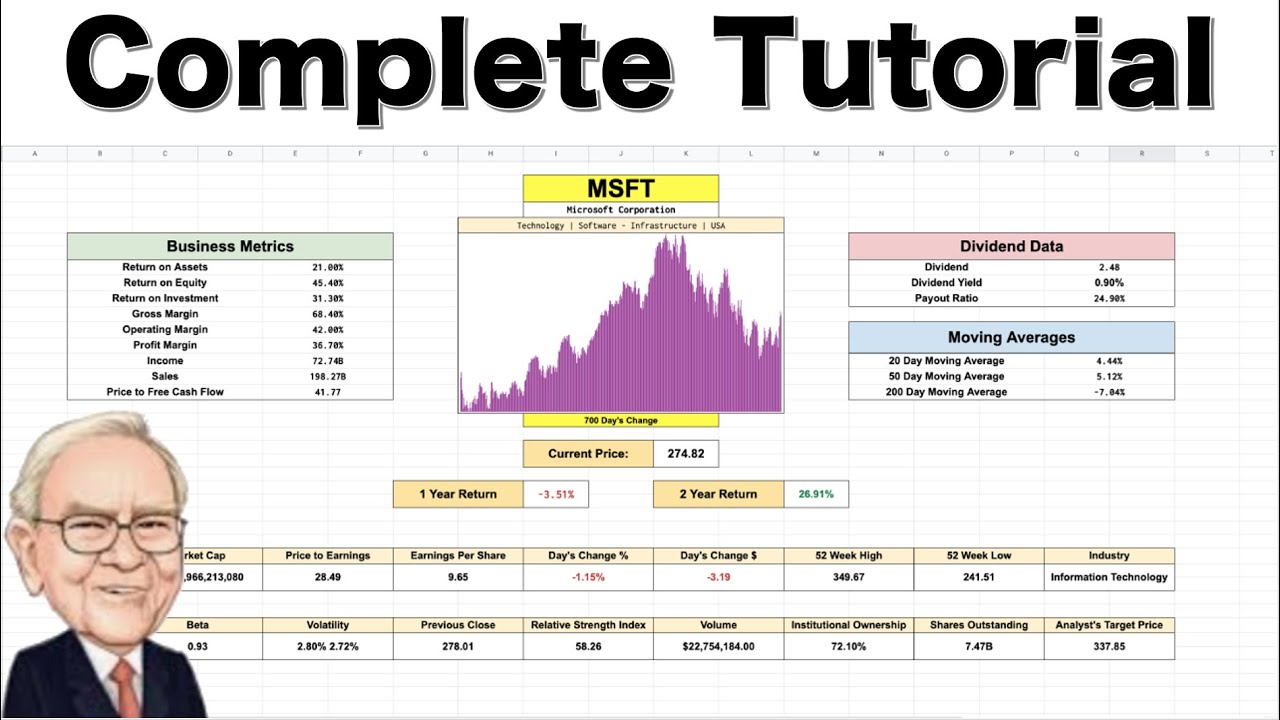

🔍 How To Value A Stock The Ultimate Guide

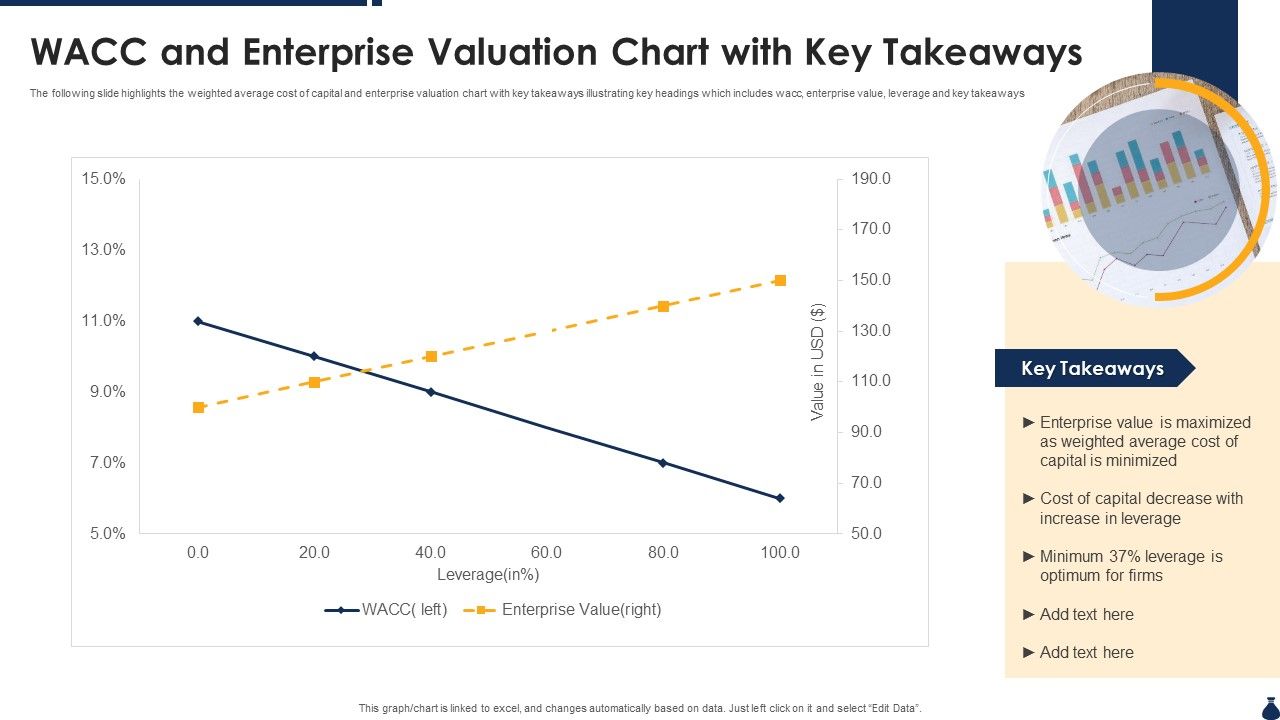

WACC And Enterprise Valuation Chart With Key Takeaways PPT Sample

How To Calculate The Value Of A Company Car at Stanley Harrison blog

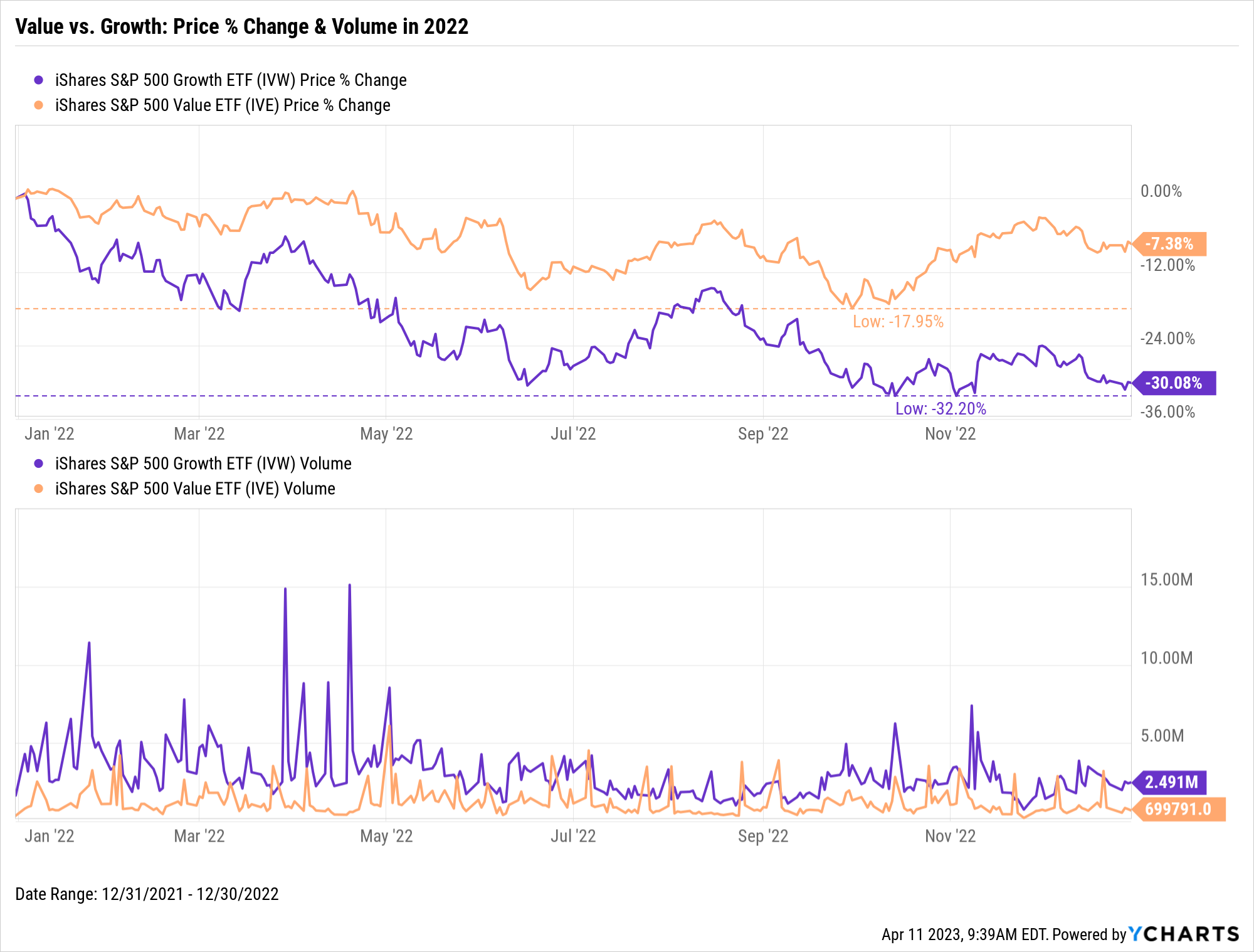

Value vs Growth Current Trends, Top Stocks & ETFs YCharts

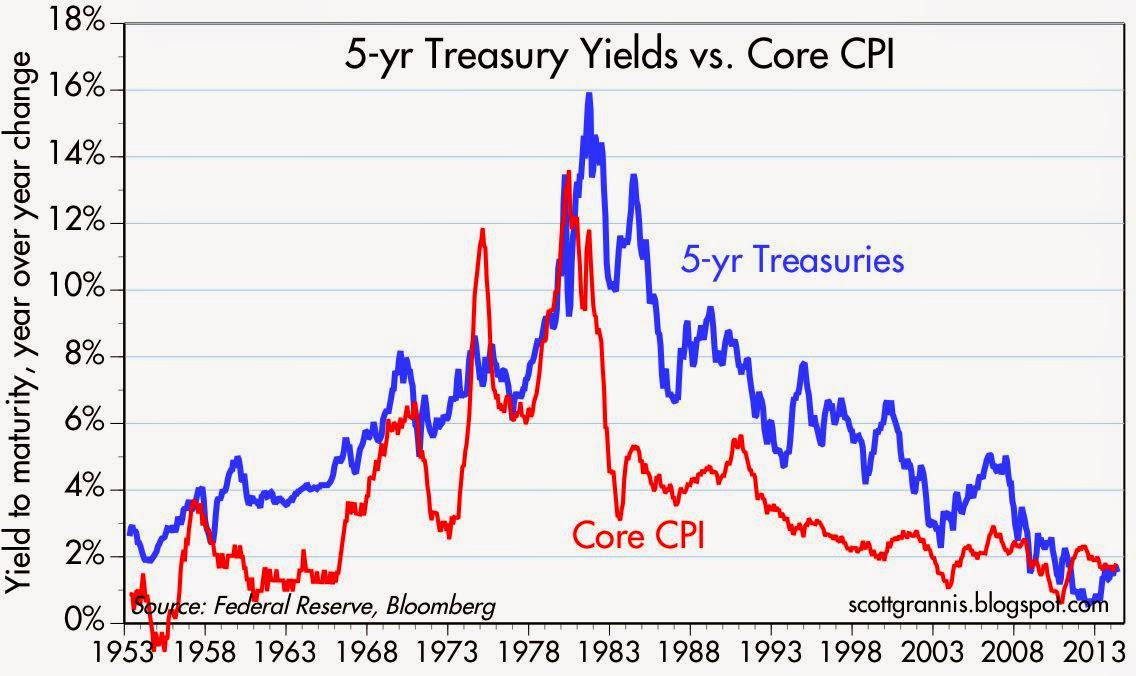

10 Valuation Charts Seeking Alpha

A Guide to the Different Types of Valuation Models for Private Companies

Valuation Methods A Guide

Stock Valuation Spreadsheet

How to Calculate Equity Value Equity IPO Guide Wealthfront

Explore Expert Valuation Resources To Build A Stronger Understanding Of Core Concepts And Techniques.

Below Are Three Major Valuation Methods That Are.

Related Post: