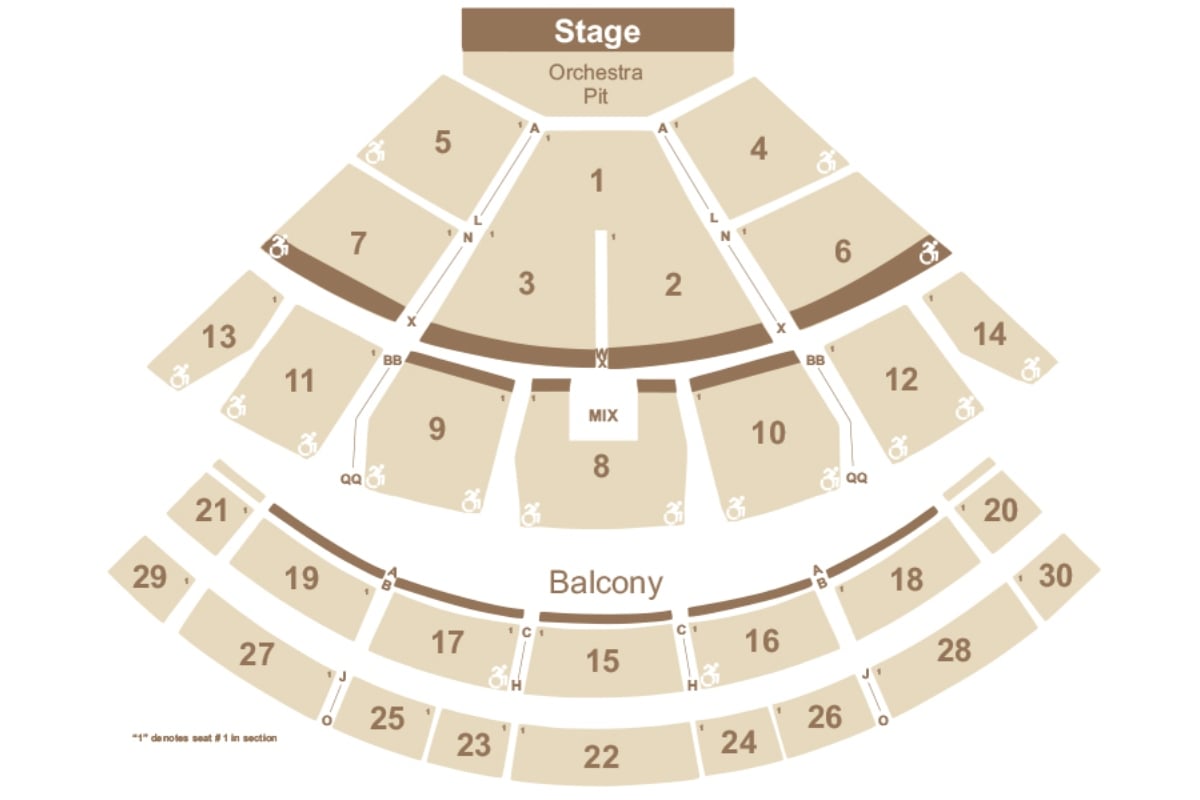

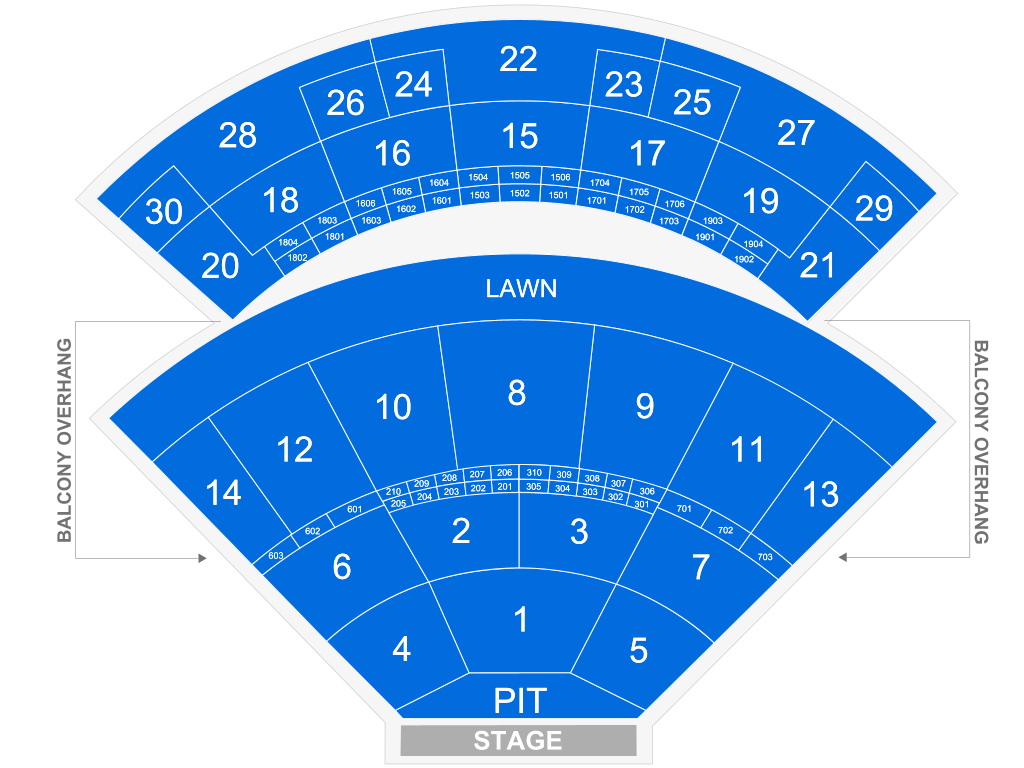

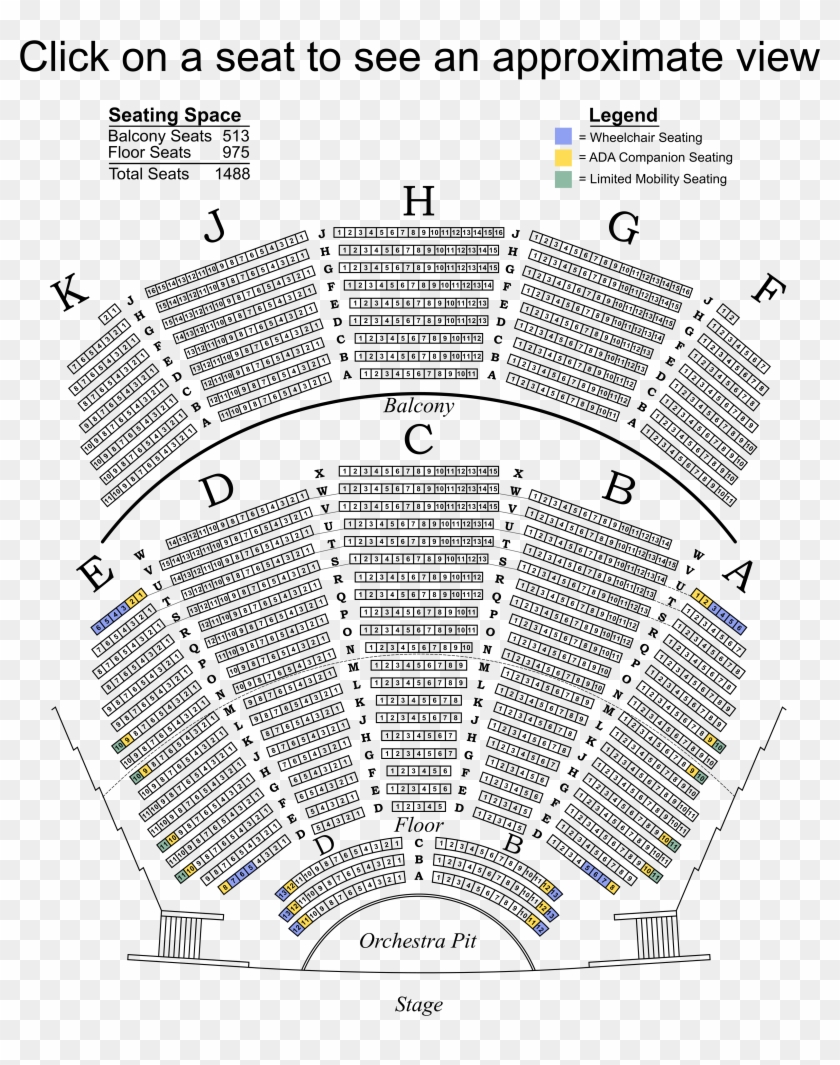

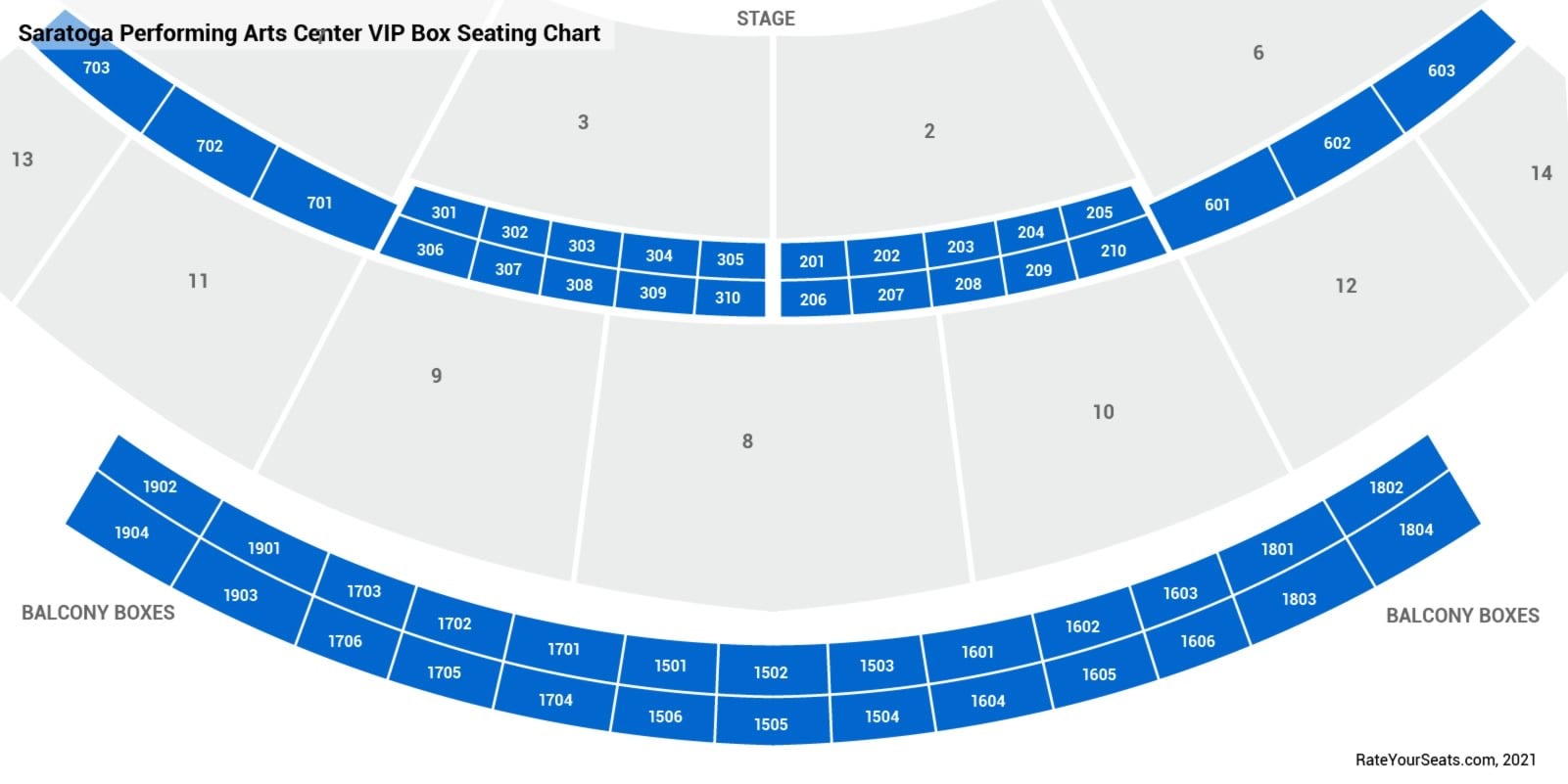

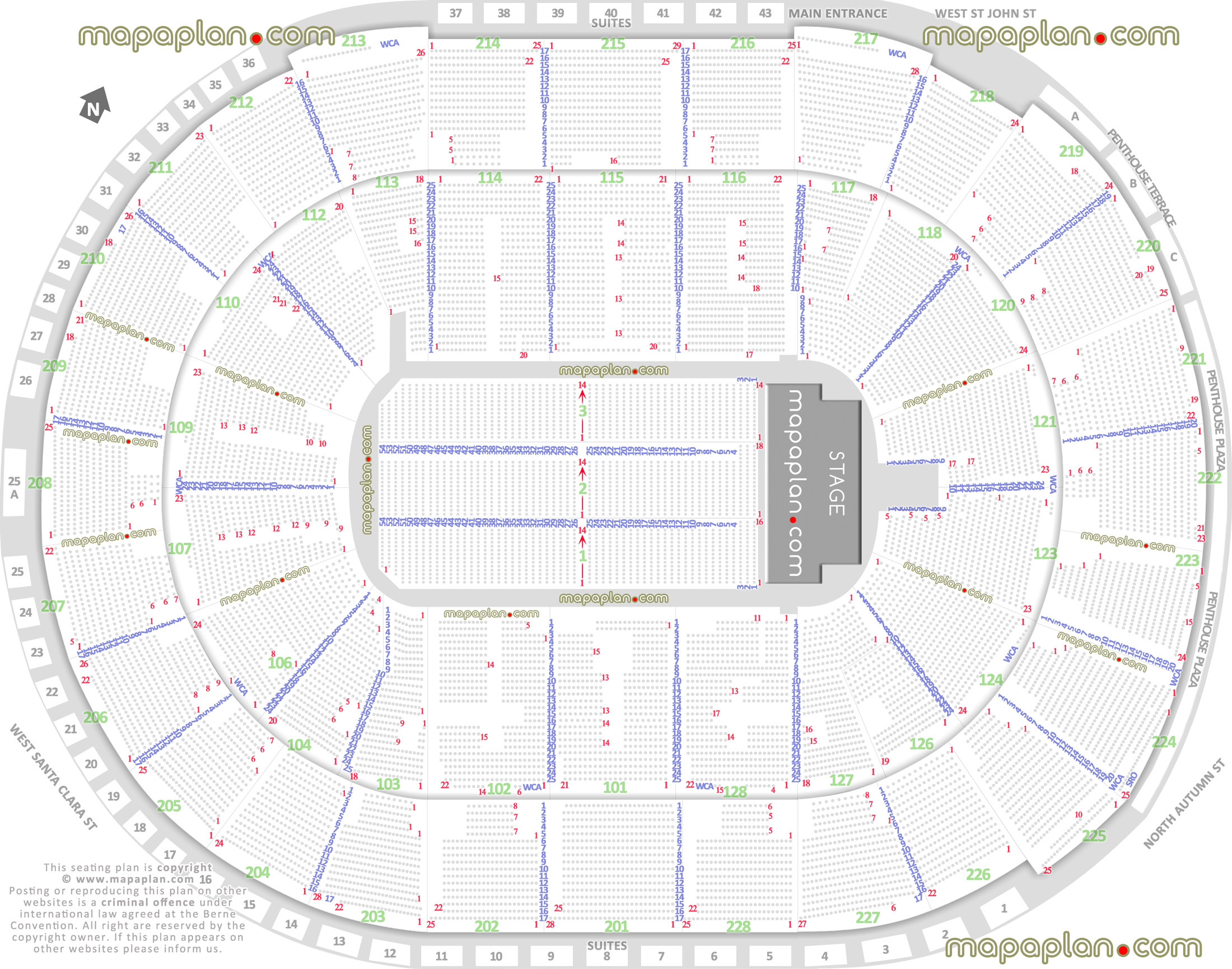

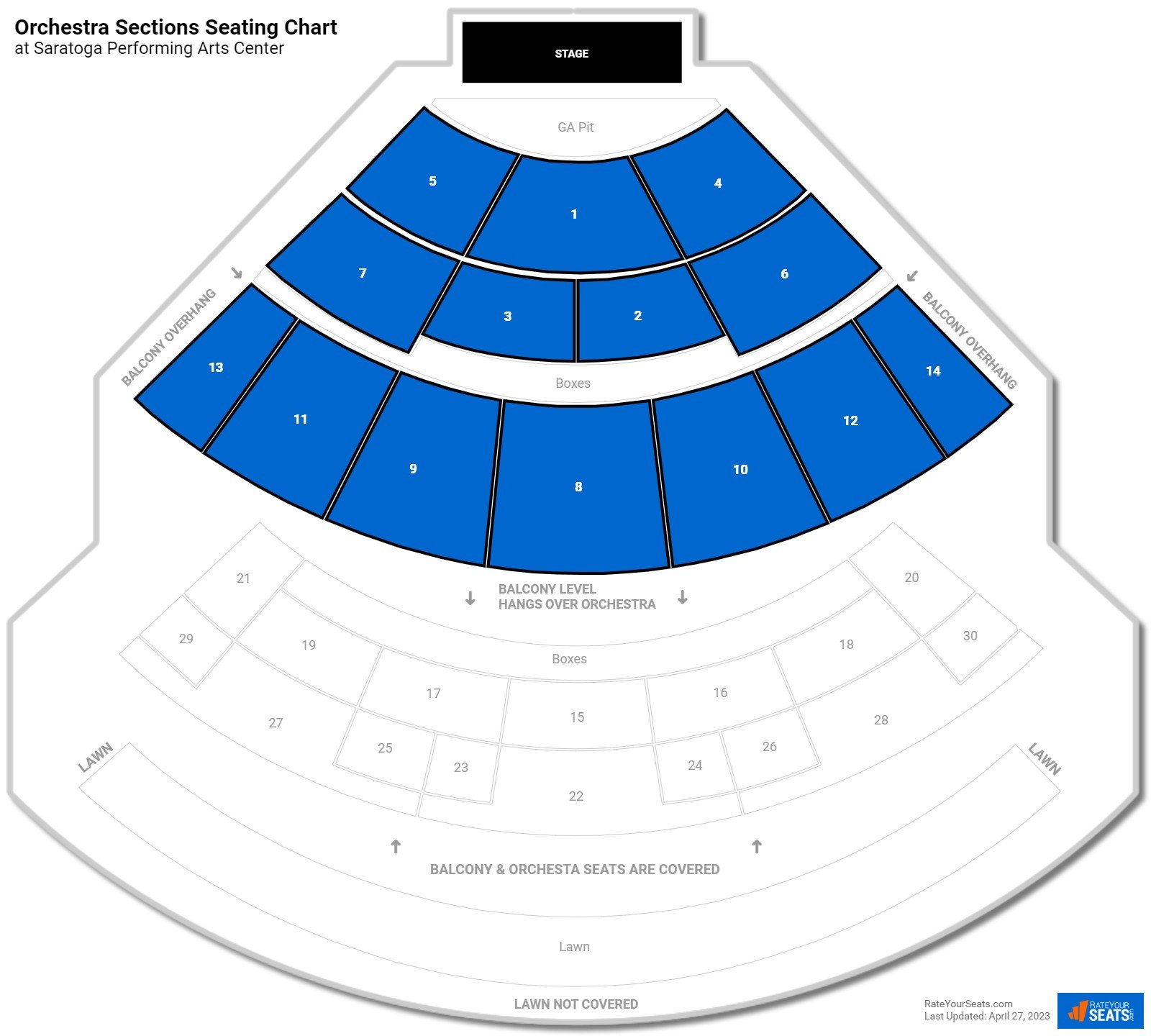

Spac Seating Chart With Seat Numbers View From My Seat

Spac Seating Chart With Seat Numbers View From My Seat - In brief spacs are investment vehicles that raise capital from investors through a traditional initial public offering (ipo) to be used later to acquire one or more target companies. Spac acquisitions are also attractive to. A spac is formed by a management team, typically known as a sponsor, that often has a business background, usually with a specific skillset in a niche industry. A special purpose acquisition company (spac) is a publicly traded company created to acquire or merge with an existing company. A spac is a shell company that goes public solely for the purpose of taking another company public. A spac is already public, so a reverse merger allows a private company to become public when the ipo window is closed. A spac, or special purpose acquisition company, is a business that raises money in the public market to acquire a private company. A spac, or a special purpose acquisition company, is a publicly listed company designed to acquire or merge with promising private companies, thus taking. A spac—which can also be known as a blank check company—is a publicly listed company designed solely to acquire one or more privately held. The saratoga performing arts center (spac), located in the historic resort town of saratoga springs in upstate new york, is one of america's most prestigious outdoor. A spac—which can also be known as a blank check company—is a publicly listed company designed solely to acquire one or more privately held. The saratoga performing arts center (spac), located in the historic resort town of saratoga springs in upstate new york, is one of america's most prestigious outdoor. Spac acquisitions are also attractive to. In brief spacs are investment vehicles that raise capital from investors through a traditional initial public offering (ipo) to be used later to acquire one or more target companies. More than $83 billion dollars were invested in spacs in. A spac is already public, so a reverse merger allows a private company to become public when the ipo window is closed. A spac is a shell company that goes public solely for the purpose of taking another company public. A spac, or special purpose acquisition company, is a business that raises money in the public market to acquire a private company. A spac is formed by a management team, typically known as a sponsor, that often has a business background, usually with a specific skillset in a niche industry. A special purpose acquisition company (spac) is a publicly traded company created to acquire or merge with an existing company. A spac is formed by a management team, typically known as a sponsor, that often has a business background, usually with a specific skillset in a niche industry. A spac, or a special purpose acquisition company, is a publicly listed company designed to acquire or merge with promising private companies, thus taking. Spac acquisitions are also attractive to. A spac. More than $83 billion dollars were invested in spacs in. Spac acquisitions are also attractive to. A spac is a shell company that goes public solely for the purpose of taking another company public. A spac, or special purpose acquisition company, is a business that raises money in the public market to acquire a private company. A spac, or a. In brief spacs are investment vehicles that raise capital from investors through a traditional initial public offering (ipo) to be used later to acquire one or more target companies. A spac, or a special purpose acquisition company, is a publicly listed company designed to acquire or merge with promising private companies, thus taking. A spac is a shell company that. A spac, or special purpose acquisition company, is a business that raises money in the public market to acquire a private company. A special purpose acquisition company (spac) is a publicly traded company created to acquire or merge with an existing company. In brief spacs are investment vehicles that raise capital from investors through a traditional initial public offering (ipo). More than $83 billion dollars were invested in spacs in. A spac—which can also be known as a blank check company—is a publicly listed company designed solely to acquire one or more privately held. The saratoga performing arts center (spac), located in the historic resort town of saratoga springs in upstate new york, is one of america's most prestigious outdoor.. A spac, or special purpose acquisition company, is a business that raises money in the public market to acquire a private company. A spac is already public, so a reverse merger allows a private company to become public when the ipo window is closed. More than $83 billion dollars were invested in spacs in. In brief spacs are investment vehicles. A spac is already public, so a reverse merger allows a private company to become public when the ipo window is closed. A spac, or special purpose acquisition company, is a business that raises money in the public market to acquire a private company. The saratoga performing arts center (spac), located in the historic resort town of saratoga springs in. In brief spacs are investment vehicles that raise capital from investors through a traditional initial public offering (ipo) to be used later to acquire one or more target companies. A spac is formed by a management team, typically known as a sponsor, that often has a business background, usually with a specific skillset in a niche industry. A spac is. A spac is already public, so a reverse merger allows a private company to become public when the ipo window is closed. In brief spacs are investment vehicles that raise capital from investors through a traditional initial public offering (ipo) to be used later to acquire one or more target companies. More than $83 billion dollars were invested in spacs. A spac is already public, so a reverse merger allows a private company to become public when the ipo window is closed. In brief spacs are investment vehicles that raise capital from investors through a traditional initial public offering (ipo) to be used later to acquire one or more target companies. Spac acquisitions are also attractive to. A spac—which can. Spac acquisitions are also attractive to. A special purpose acquisition company (spac) is a publicly traded company created to acquire or merge with an existing company. A spac is already public, so a reverse merger allows a private company to become public when the ipo window is closed. A spac is a shell company that goes public solely for the purpose of taking another company public. A spac—which can also be known as a blank check company—is a publicly listed company designed solely to acquire one or more privately held. A spac, or a special purpose acquisition company, is a publicly listed company designed to acquire or merge with promising private companies, thus taking. A spac, or special purpose acquisition company, is a business that raises money in the public market to acquire a private company. In brief spacs are investment vehicles that raise capital from investors through a traditional initial public offering (ipo) to be used later to acquire one or more target companies.Saratoga Performing Arts Center (SPAC) Seating Chart

Live Nation Entertainment Saratoga Performing Arts Center

Spac Seating Chart Portal.posgradount.edu.pe

Spac Seating Chart Detailed

Spac Seating Chart Portal.posgradount.edu.pe

Spac Seating Chart With Rows And Seat Numbers Portal.posgradount.edu.pe

Spac Seating Chart With Rows

SPACSaratoga Performing Arts Center Seating Charts

Spac Seating Chart With Seat Numbers

Seating Chart Saratoga Performing Arts Center Center Seating Chart

A Spac Is Formed By A Management Team, Typically Known As A Sponsor, That Often Has A Business Background, Usually With A Specific Skillset In A Niche Industry.

The Saratoga Performing Arts Center (Spac), Located In The Historic Resort Town Of Saratoga Springs In Upstate New York, Is One Of America's Most Prestigious Outdoor.

More Than $83 Billion Dollars Were Invested In Spacs In.

Related Post: