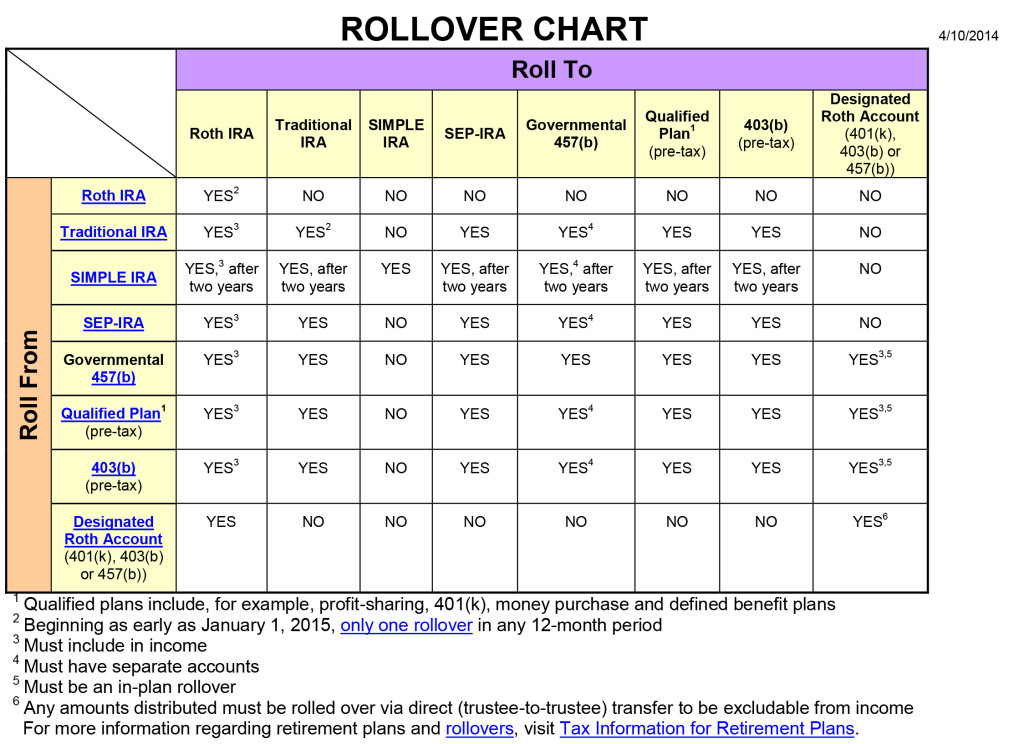

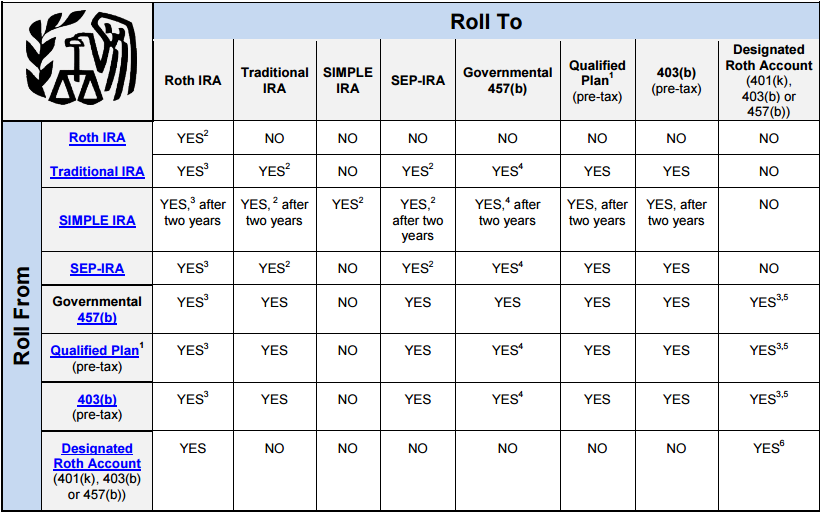

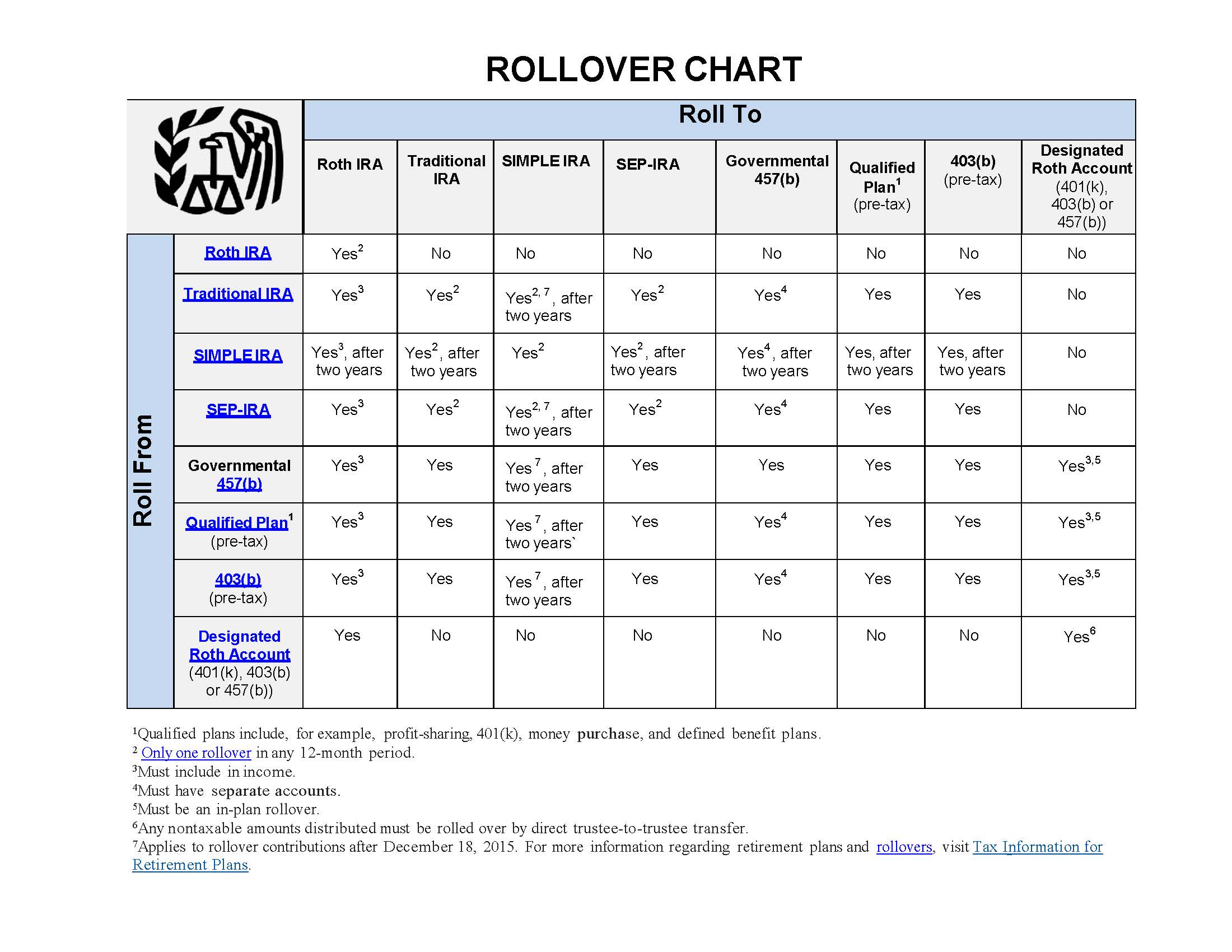

Rollover Chart

Rollover Chart - The maximum total yearly contribution that an individual can make to all individual iras is the lesser of the individual’s taxable compensation for the year (this does not include rollovers), or. Find out how and when to roll over your retirement plan or ira to another retirement plan or ira. See the rollover chart pdf for a summary of your account transfer. Rollovers (see our rollover chart pdf) the why, what, how, when and where about moving your retirement savings. A retirement plan administrator should take reasonable steps to evaluate whether incoming rollover contributions meet the requirements. Pretax amounts to a traditional ira or. Review a chart of allowable rollover transactions. See the rollover chart pdf for a summary of your account transfer. Find out how and when to roll over your retirement plan or ira to another retirement plan or ira. The maximum total yearly contribution that an individual can make to all individual iras is the lesser of the individual’s taxable compensation for the year (this does not include rollovers), or. Pretax amounts to a traditional ira or. Rollovers (see our rollover chart pdf) the why, what, how, when and where about moving your retirement savings. Review a chart of allowable rollover transactions. A retirement plan administrator should take reasonable steps to evaluate whether incoming rollover contributions meet the requirements. A retirement plan administrator should take reasonable steps to evaluate whether incoming rollover contributions meet the requirements. Find out how and when to roll over your retirement plan or ira to another retirement plan or ira. The maximum total yearly contribution that an individual can make to all individual iras is the lesser of the individual’s taxable compensation for the. Rollovers (see our rollover chart pdf) the why, what, how, when and where about moving your retirement savings. Pretax amounts to a traditional ira or. A retirement plan administrator should take reasonable steps to evaluate whether incoming rollover contributions meet the requirements. See the rollover chart pdf for a summary of your account transfer. The maximum total yearly contribution that. Find out how and when to roll over your retirement plan or ira to another retirement plan or ira. See the rollover chart pdf for a summary of your account transfer. A retirement plan administrator should take reasonable steps to evaluate whether incoming rollover contributions meet the requirements. Pretax amounts to a traditional ira or. Rollovers (see our rollover chart. Pretax amounts to a traditional ira or. Rollovers (see our rollover chart pdf) the why, what, how, when and where about moving your retirement savings. Find out how and when to roll over your retirement plan or ira to another retirement plan or ira. See the rollover chart pdf for a summary of your account transfer. The maximum total yearly. A retirement plan administrator should take reasonable steps to evaluate whether incoming rollover contributions meet the requirements. Pretax amounts to a traditional ira or. The maximum total yearly contribution that an individual can make to all individual iras is the lesser of the individual’s taxable compensation for the year (this does not include rollovers), or. Find out how and when. A retirement plan administrator should take reasonable steps to evaluate whether incoming rollover contributions meet the requirements. Review a chart of allowable rollover transactions. See the rollover chart pdf for a summary of your account transfer. Pretax amounts to a traditional ira or. Find out how and when to roll over your retirement plan or ira to another retirement plan. A retirement plan administrator should take reasonable steps to evaluate whether incoming rollover contributions meet the requirements. See the rollover chart pdf for a summary of your account transfer. Find out how and when to roll over your retirement plan or ira to another retirement plan or ira. Rollovers (see our rollover chart pdf) the why, what, how, when and. Pretax amounts to a traditional ira or. A retirement plan administrator should take reasonable steps to evaluate whether incoming rollover contributions meet the requirements. The maximum total yearly contribution that an individual can make to all individual iras is the lesser of the individual’s taxable compensation for the year (this does not include rollovers), or. See the rollover chart pdf. Pretax amounts to a traditional ira or. Rollovers (see our rollover chart pdf) the why, what, how, when and where about moving your retirement savings. The maximum total yearly contribution that an individual can make to all individual iras is the lesser of the individual’s taxable compensation for the year (this does not include rollovers), or. Review a chart of. Find out how and when to roll over your retirement plan or ira to another retirement plan or ira. See the rollover chart pdf for a summary of your account transfer. A retirement plan administrator should take reasonable steps to evaluate whether incoming rollover contributions meet the requirements. Pretax amounts to a traditional ira or. Rollovers (see our rollover chart. Find out how and when to roll over your retirement plan or ira to another retirement plan or ira. See the rollover chart pdf for a summary of your account transfer. The maximum total yearly contribution that an individual can make to all individual iras is the lesser of the individual’s taxable compensation for the year (this does not include rollovers), or. Pretax amounts to a traditional ira or. Review a chart of allowable rollover transactions.IRA Transfer vs. Rollover What's the Difference?

IRS Rollover Chart TPS Group

IRA Rollover Chart Rules Regarding Rollovers and Conversions AAII

Rollover Rules Chart A Visual Reference of Charts Chart Master

Rollover Chart DFW Divorce FinancesDFW Divorce Finances

IRS issues updated Rollover Chart The Retirement Plan Blog

Follow the Rules When Rolling Over Your EmployerSponsored Retirement Plan Rodgers & Associates

IRA Rollover Chart Where Can You Move Your Account?

Individual Retirement Accounts (IRAs) Prosperity Financial Group San Ramon, CA

401(k) Rollover Rules Ameritas

A Retirement Plan Administrator Should Take Reasonable Steps To Evaluate Whether Incoming Rollover Contributions Meet The Requirements.

Rollovers (See Our Rollover Chart Pdf) The Why, What, How, When And Where About Moving Your Retirement Savings.

Related Post: