Qqqm Chart

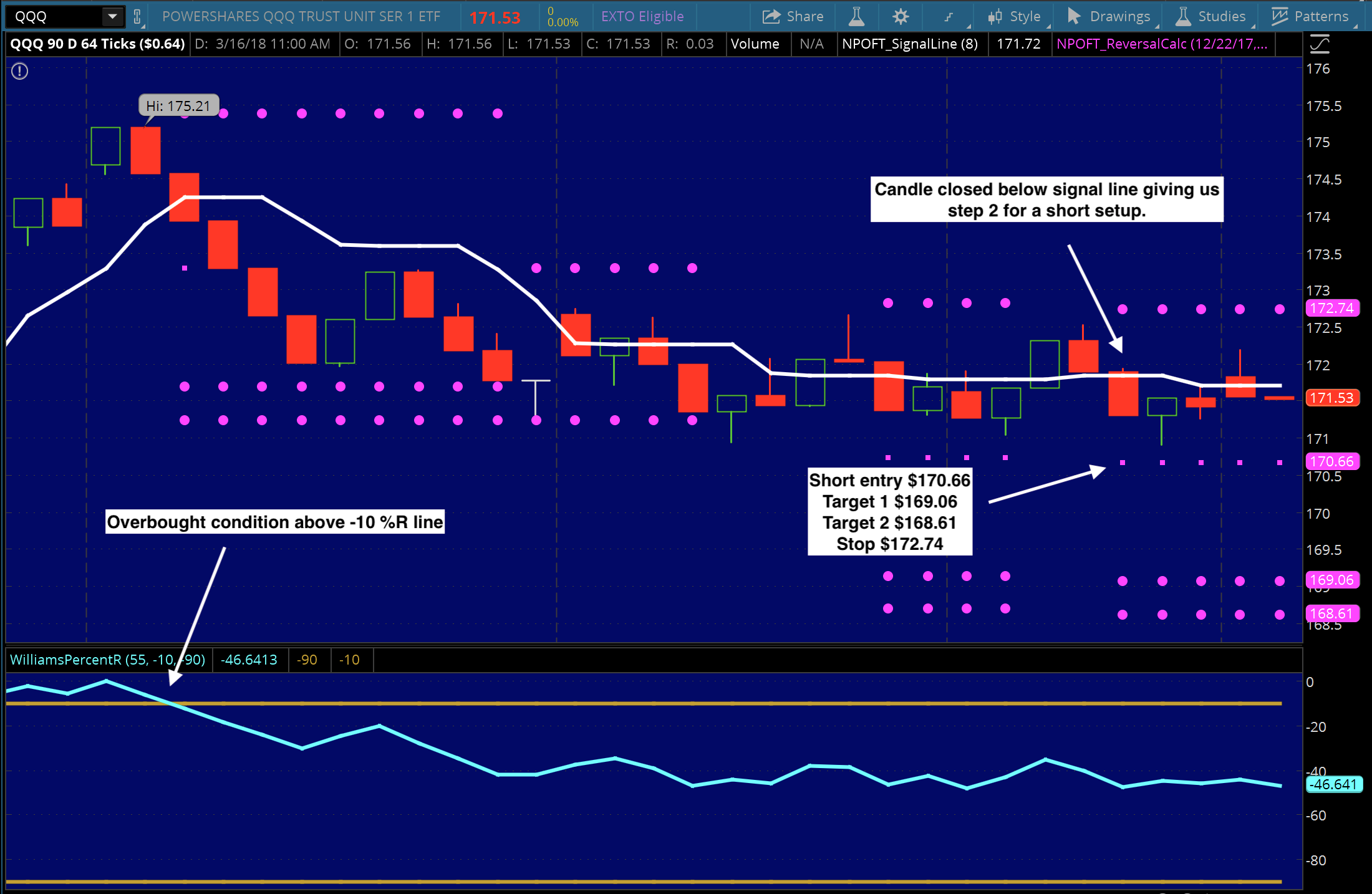

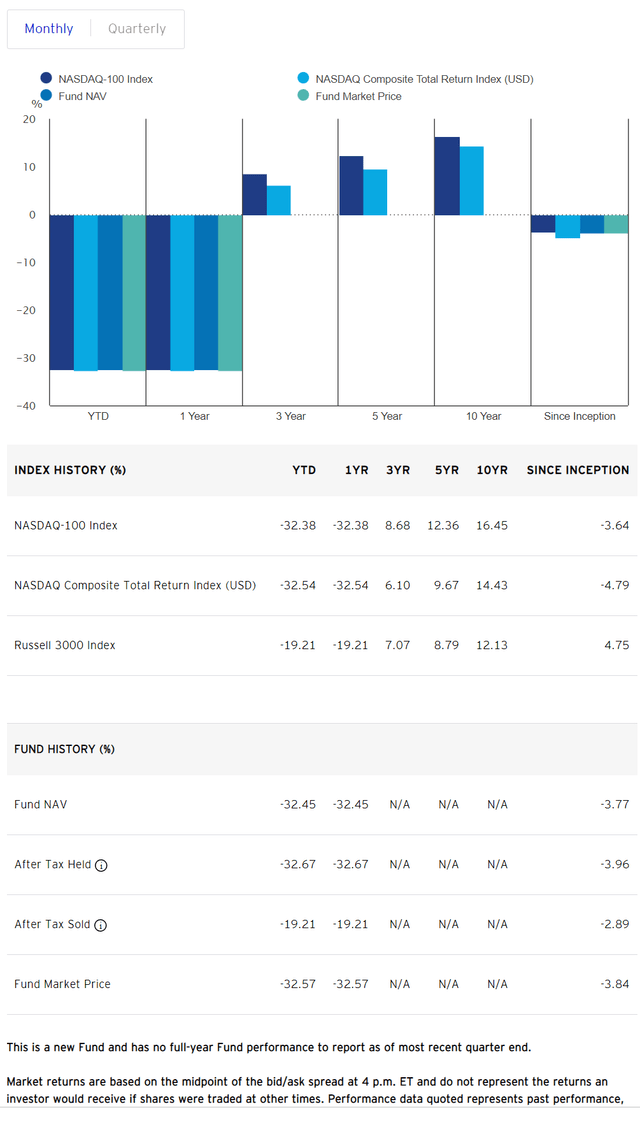

Qqqm Chart - I only started investing for the first time about a year ago and have been buying almost exclusively qqq. In my portfolio i currently invest in voo and schd. The only difference is qqq cost 0.20%. The difference is 5 basis points. Qqqm itself has only existed for 4 years and in that 4 years it's slightly underperformed the market. If you ignore past performance, why is it a good idea to put your money in qqq/qqqm at all? Qqqm is up less only because it is younger, less than five years old. They are exactly the same. Qqqm has been treating me very nicely since i purchased it a few weeks ago. Intuitively, if you want growth, putting your money in a broader index etf like spyg, vug,. Qqqm is up less only because it is younger, less than five years old. It's obviously the same thing as qqq which has existed for 25 years. If you ignore past performance, why is it a good idea to put your money in qqq/qqqm at all? Searched extensively about qqqm vs qqq and the only difference i could find was that qqqm was slightly better in terms of lower expense ratio and composition is a bit. In my portfolio i currently invest in voo and schd. Qqqm itself has only existed for 4 years and in that 4 years it's slightly underperformed the market. The difference is 5 basis points. They are exactly the same. Qqqm has been treating me very nicely since i purchased it a few weeks ago. However, it's subject to more volatility than broader market indices like voo. Qqqm has been treating me very nicely since i purchased it a few weeks ago. Qqqm itself has only existed for 4 years and in that 4 years it's slightly underperformed the market. I have around 60% voo and 40% schd. They are the same thing. I only started investing for the first time about a year ago and have. In my portfolio i currently invest in voo and schd. Just that qqqm inception was october 2020. The difference is 5 basis points. I have been researching more etf's to add a third to my account. It's obviously the same thing as qqq which has existed for 25 years. I have been researching more etf's to add a third to my account. Qqqm has been treating me very nicely since i purchased it a few weeks ago. Qqqm is up less only because it is younger, less than five years old. The difference is 5 basis points. Qqqm itself has only existed for 4 years and in that 4. It's obviously the same thing as qqq which has existed for 25 years. If you ignore past performance, why is it a good idea to put your money in qqq/qqqm at all? The only difference is qqq cost 0.20%. They are the same thing. Since qqqm was founded in october 2020 its total return is +52.16% while qqq's is 51.86%. Intuitively, if you want growth, putting your money in a broader index etf like spyg, vug,. The only difference is qqq cost 0.20%. Qqqm has been treating me very nicely since i purchased it a few weeks ago. I only started investing for the first time about a year ago and have been buying almost exclusively qqq. The difference is. Qqqm offers good sector diversification, primarily in tech, and has historically shown strong growth. If you ignore past performance, why is it a good idea to put your money in qqq/qqqm at all? Qqqm is up less only because it is younger, less than five years old. Qqqm has been treating me very nicely since i purchased it a few. Intuitively, if you want growth, putting your money in a broader index etf like spyg, vug,. I have been researching more etf's to add a third to my account. Since qqqm was founded in october 2020 its total return is +52.16% while qqq's is 51.86%. The difference is 5 basis points. Searched extensively about qqqm vs qqq and the only. I have been researching more etf's to add a third to my account. Searched extensively about qqqm vs qqq and the only difference i could find was that qqqm was slightly better in terms of lower expense ratio and composition is a bit. However, it's subject to more volatility than broader market indices like voo. Intuitively, if you want growth,. The only difference is qqq cost 0.20%. Qqqm itself has only existed for 4 years and in that 4 years it's slightly underperformed the market. Qqqm offers good sector diversification, primarily in tech, and has historically shown strong growth. Since qqqm was founded in october 2020 its total return is +52.16% while qqq's is 51.86%. Qqqm is up less only. Qqqm is up less only because it is younger, less than five years old. I have been researching more etf's to add a third to my account. Since qqqm was founded in october 2020 its total return is +52.16% while qqq's is 51.86%. Intuitively, if you want growth, putting your money in a broader index etf like spyg, vug,. Qqqm. Searched extensively about qqqm vs qqq and the only difference i could find was that qqqm was slightly better in terms of lower expense ratio and composition is a bit. However, it's subject to more volatility than broader market indices like voo. They are exactly the same. Since qqqm was founded in october 2020 its total return is +52.16% while qqq's is 51.86%. Qqqm has been treating me very nicely since i purchased it a few weeks ago. Intuitively, if you want growth, putting your money in a broader index etf like spyg, vug,. Qqqm is up less only because it is younger, less than five years old. It's obviously the same thing as qqq which has existed for 25 years. I only started investing for the first time about a year ago and have been buying almost exclusively qqq. The difference is 5 basis points. If you ignore past performance, why is it a good idea to put your money in qqq/qqqm at all? I have around 60% voo and 40% schd. Qqqm itself has only existed for 4 years and in that 4 years it's slightly underperformed the market. The only difference is qqq cost 0.20%. Just that qqqm inception was october 2020.Comparing Nasdaq 100 ETFs RealLife Examples with QQQ & QQQM Forex Systems, Research, And Reviews

QQQM Stock Fund Price and Chart — NASDAQQQQM — TradingView

QQQM Stock Fund Price and Chart — NASDAQQQQM — TradingView

Invesco NASDAQ 100 ETF Chart QQQM ADVFN

【美股入門】QQQM (Invesco NASDAQ 100 ETF) QQQ之外的另一個選擇! QQQM 好嗎? 可以買嗎? QQQ vs. QQQM 有何不同? 聰明主婦の生活投資學

QQQM Stock Fund Price and Chart — NASDAQQQQM — TradingView

Qqq Options Chart A Visual Reference of Charts Chart Master

Invesco NASDAQ 100 ETF Worthwhile To Switch From QQQ (NASDAQQQQM) Seeking Alpha

QQQM (Invesco NASDAQ 100 ETF) Technical Charts and Market Data TrendSpider

QQQM Stock Fund Price and Chart — NASDAQQQQM — TradingView

I Have Been Researching More Etf's To Add A Third To My Account.

In My Portfolio I Currently Invest In Voo And Schd.

They Are The Same Thing.

Qqqm Offers Good Sector Diversification, Primarily In Tech, And Has Historically Shown Strong Growth.

Related Post: