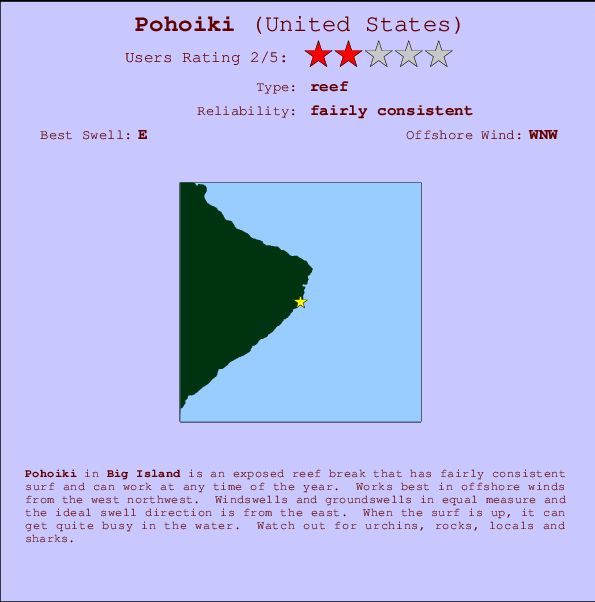

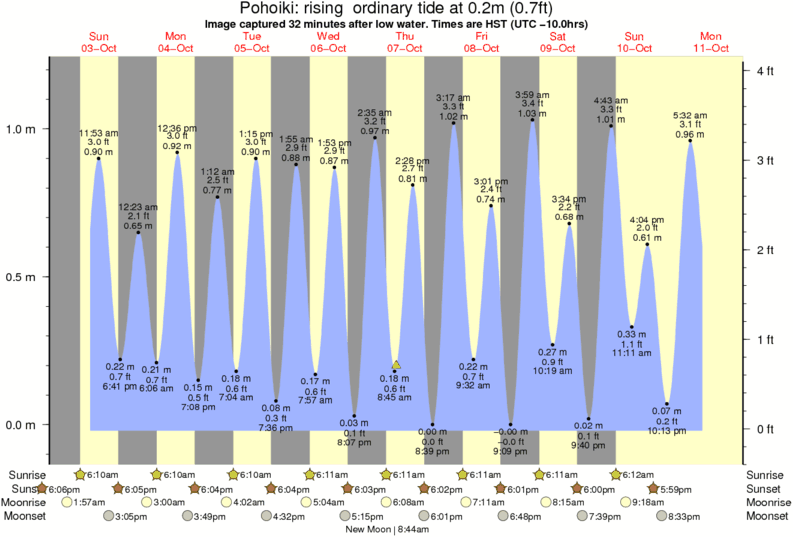

Pohoiki Tide Chart

Pohoiki Tide Chart - If you initiate the money transfer from your. When using your card abroad, your bank can levy fees. 1 you only pay a fee if you withdraw money in other currencies. Famous banks like bnl, banco nazionale del lavoro, ing, and unicredit cater to expats. Their fees (or lack thereof) for international use is one their. You must be 18 to open an account. What are foreign transaction fees and how do they work? An n26 bank account is free.* * if we’re not able to offer you an n26 account based on our minimum requirements, you may be able to open an n26. If you add money from within the n26 app (eg charging a credit card or using apple pay), then you will pay 3% fee to n26. Transfers & debits transfers received from or within eea states and switzerland in euro are free. Please give me feedback using the comments feature about what current account you decided. What are foreign transaction fees and how do they work? When you make a purchase in another currency, some banks and card companies charge a fee to facilitate the transaction. Transfers & debits transfers received from or within eea states and switzerland in euro are free. If you initiate the money transfer from your. If you add money from within the n26 app (eg charging a credit card or using apple pay), then you will pay 3% fee to n26. Famous banks like bnl, banco nazionale del lavoro, ing, and unicredit cater to expats. An n26 bank account is free.* * if we’re not able to offer you an n26 account based on our minimum requirements, you may be able to open an n26. 1 you only pay a fee if you withdraw money in other currencies. To charge customers “as little as possible” n26 offers low to zero fees. 1 you only pay a fee if you withdraw money in other currencies. What are foreign transaction fees and how do they work? There are no transaction fees and no currency conversion fees. If you add money from within the n26 app (eg charging a credit card or using apple pay), then you will pay 3% fee to n26. Their. There are providers without foreign transaction fee. When using your card abroad, your bank can levy fees. While there’s often a payment fee charge on the basis of the overseas payment itself, you could also face a foreign transaction fee. There are no transaction fees and no currency conversion fees. What are foreign transaction fees and how do they work? Their fees (or lack thereof) for international use is one their. If you add money from within the n26 app (eg charging a credit card or using apple pay), then you will pay 3% fee to n26. There are no transaction fees and no currency conversion fees. Please give me feedback using the comments feature about what current account you. How much does an n26 account cost? 1 you only pay a fee if you withdraw money in other currencies. An n26 bank account is free.* * if we’re not able to offer you an n26 account based on our minimum requirements, you may be able to open an n26. Their fees (or lack thereof) for international use is one. There are providers without foreign transaction fee. How much does an n26 account cost? When using your card abroad, your bank can levy fees. Famous banks like bnl, banco nazionale del lavoro, ing, and unicredit cater to expats. To charge customers “as little as possible” n26 offers low to zero fees. When you make a purchase in another currency, some banks and card companies charge a fee to facilitate the transaction. Transfers & debits transfers received from or within eea states and switzerland in euro are free. Please give me feedback using the comments feature about what current account you decided. Basic services like opening a bank account shouldcost next to. While there’s often a payment fee charge on the basis of the overseas payment itself, you could also face a foreign transaction fee. You must be 18 to open an account. You pay the real exchange rate. Famous banks like bnl, banco nazionale del lavoro, ing, and unicredit cater to expats. Transfers & debits transfers received from or within eea. What are foreign transaction fees and how do they work? If you initiate the money transfer from your. Basic services like opening a bank account shouldcost next to nothing, but there are many different reasons for paying fees to your bank, whether it’s a monthly maintenance fee or a. To charge customers “as little as possible” n26 offers low to. When you make a purchase in another currency, some banks and card companies charge a fee to facilitate the transaction. When using your card abroad, your bank can levy fees. If you add money from within the n26 app (eg charging a credit card or using apple pay), then you will pay 3% fee to n26. Famous banks like bnl,. Their fees (or lack thereof) for international use is one their. Basic services like opening a bank account shouldcost next to nothing, but there are many different reasons for paying fees to your bank, whether it’s a monthly maintenance fee or a. Please give me feedback using the comments feature about what current account you decided. An n26 bank account. While there’s often a payment fee charge on the basis of the overseas payment itself, you could also face a foreign transaction fee. Famous banks like bnl, banco nazionale del lavoro, ing, and unicredit cater to expats. An n26 bank account is free.* * if we’re not able to offer you an n26 account based on our minimum requirements, you may be able to open an n26. How much does an n26 account cost? Please give me feedback using the comments feature about what current account you decided. You must be 18 to open an account. If you initiate the money transfer from your. To charge customers “as little as possible” n26 offers low to zero fees. There are providers without foreign transaction fee. When you make a purchase in another currency, some banks and card companies charge a fee to facilitate the transaction. Transfers & debits transfers received from or within eea states and switzerland in euro are free. There are no transaction fees and no currency conversion fees. You pay the real exchange rate. When using your card abroad, your bank can levy fees. What are foreign transaction fees and how do they work?Pohoiki Prévisions de Surf et Surf Report (HAW Big Island, USA)

Pohoiki Surf Photo by Edy 917 am 7 Oct 2010

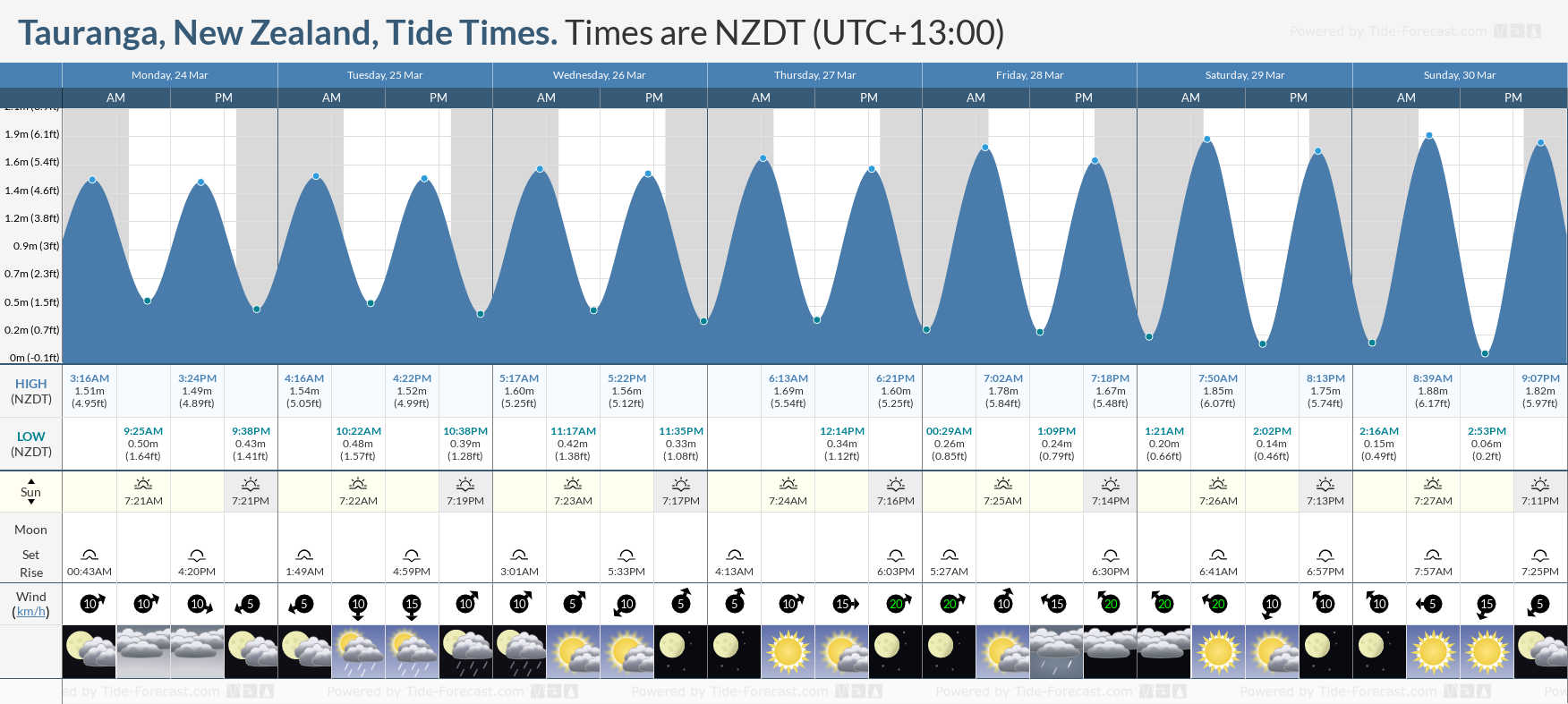

Tide Charts For 2025 Josey Pandora

2025 Tide Tables West Coast of North America Including the Hawaiian I Captain's Nautical

Pohoiki Surf Photo by Greg 1151 am 14 Jan 2006

Pohoiki Surf Photo by Christina Colberg 712 pm 8 Aug 2019

Pohoiki Bay Restoration Draft Environmental Assessment Published

Noaa Tides And Charts

Pohoiki Surf Photo by steve scott 1227 am 19 Jul 2010

Pohoiki Bay Dredging Set to Begin in Early 2025, Bringing LongAwaited

Basic Services Like Opening A Bank Account Shouldcost Next To Nothing, But There Are Many Different Reasons For Paying Fees To Your Bank, Whether It’s A Monthly Maintenance Fee Or A.

1 You Only Pay A Fee If You Withdraw Money In Other Currencies.

If You Add Money From Within The N26 App (Eg Charging A Credit Card Or Using Apple Pay), Then You Will Pay 3% Fee To N26.

Their Fees (Or Lack Thereof) For International Use Is One Their.

Related Post: