Partnership Chart Of Accounts

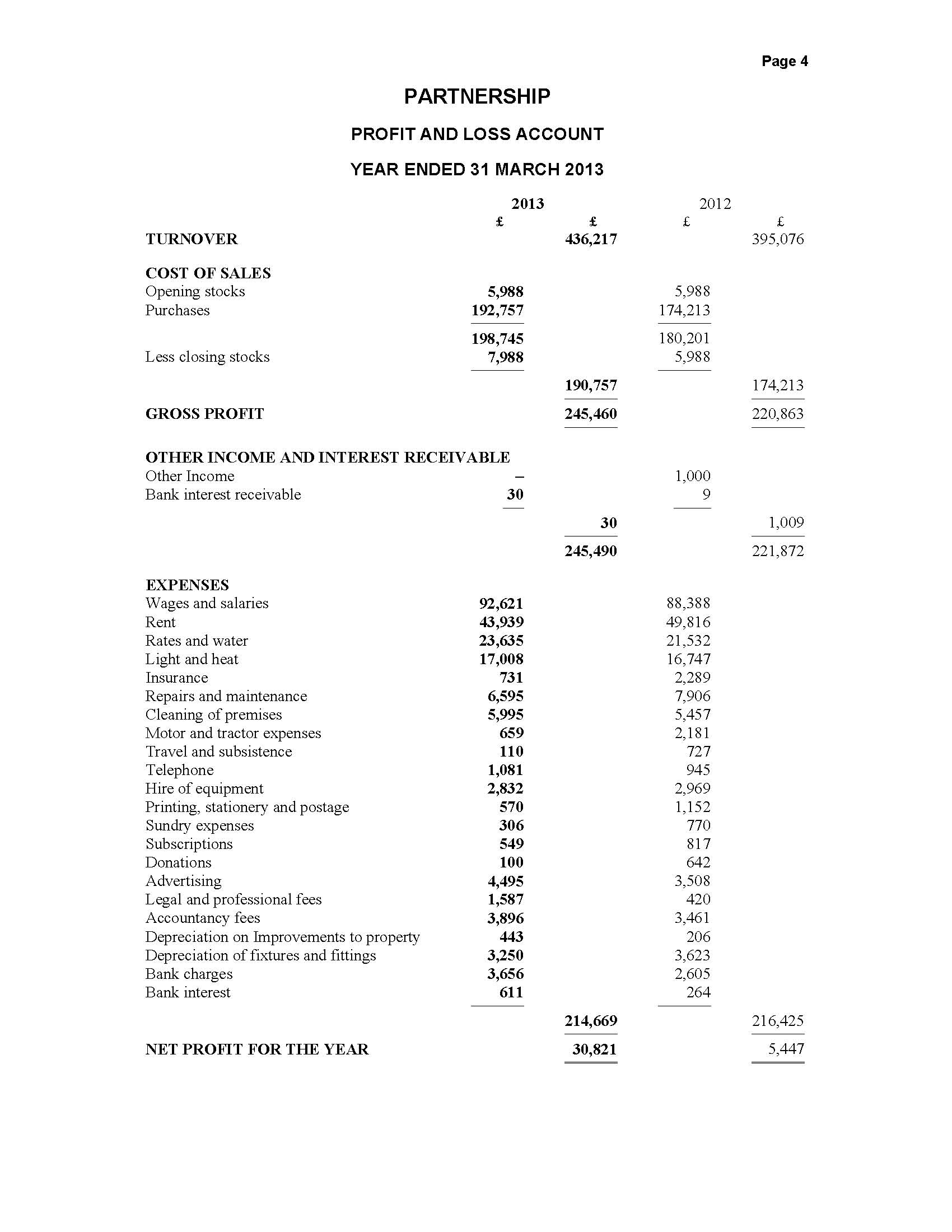

Partnership Chart Of Accounts - In this article, we will explore the different aspects of. In this article, we discuss what a partnership is, the different types, what to look for in a partner, partnership taxation and the steps you can follow to choose the right partner. A partnership is the relationship between two or more people to do trade or business. According to section 4 of the partnership act of 1932,partnership is defined as the relation between two or more persons who have agreed to share the profits of a business carried on. Each person contributes money, property, labor or skill, and shares in the profits and. Learn how partnerships work and their advantages and disadvantages. A partnership is a collaborative relationship between two or more parties aimed at achieving shared goals or mutual benefits. A partnership is the simplest business structure for companies with more than one owner. It can take various forms,. Partnerships are one of the most popular options as they allow the pooling of resources and reduce the burden on a single individual. The meaning of partnership is the state of being a partner : Partnerships are one of the most popular options as they allow the pooling of resources and reduce the burden on a single individual. There are several types of. A partnership is a formal arrangement by two or more parties to manage and operate a business and share its profits. A partnership is a collaborative relationship between two or more parties aimed at achieving shared goals or mutual benefits. According to section 4 of the partnership act of 1932,partnership is defined as the relation between two or more persons who have agreed to share the profits of a business carried on. Explore the legal framework of partnerships, including formation, liability, obligations, and dissolution processes. How to use partnership in a sentence. A partnership is the relationship between two or more people to do trade or business. Each person contributes money, property, labor or skill, and shares in the profits and. Learn how partnerships work and their advantages and disadvantages. Each person contributes money, property, labor or skill, and shares in the profits and. A partnership is a formal arrangement by two or more parties to manage and operate a business and share its profits. In this article, we discuss what a partnership is, the different types, what to look for. A partnership is the relationship between two or more people to do trade or business. A partnership is a business arrangement where two or. A partnership is a collaborative relationship between two or more parties aimed at achieving shared goals or mutual benefits. In this article, we will explore the different aspects of. Partnerships are one of the most popular. According to section 4 of the partnership act of 1932,partnership is defined as the relation between two or more persons who have agreed to share the profits of a business carried on. There are several types of. It can take various forms,. Partnerships are one of the most popular options as they allow the pooling of resources and reduce the. A partnership is the relationship between two or more people to do trade or business. In this article, we will explore the different aspects of. The meaning of partnership is the state of being a partner : A partnership is a collaborative relationship between two or more parties aimed at achieving shared goals or mutual benefits. A partnership is a. There are several types of. A partnership is the simplest business structure for companies with more than one owner. It can take various forms,. According to section 4 of the partnership act of 1932,partnership is defined as the relation between two or more persons who have agreed to share the profits of a business carried on. In this article, we. According to section 4 of the partnership act of 1932,partnership is defined as the relation between two or more persons who have agreed to share the profits of a business carried on. A partnership is a business arrangement where two or. In this article, we discuss what a partnership is, the different types, what to look for in a partner,. Explore the legal framework of partnerships, including formation, liability, obligations, and dissolution processes. Learn how partnerships work and their advantages and disadvantages. Partnerships are one of the most popular options as they allow the pooling of resources and reduce the burden on a single individual. There are several types of. In this article, we will explore the different aspects of. In this article, we will explore the different aspects of. There are several types of. Each person contributes money, property, labor or skill, and shares in the profits and. It can take various forms,. In this article, we discuss what a partnership is, the different types, what to look for in a partner, partnership taxation and the steps you can. According to section 4 of the partnership act of 1932,partnership is defined as the relation between two or more persons who have agreed to share the profits of a business carried on. In this article, we discuss what a partnership is, the different types, what to look for in a partner, partnership taxation and the steps you can follow to. The meaning of partnership is the state of being a partner : A partnership is a collaborative relationship between two or more parties aimed at achieving shared goals or mutual benefits. A partnership is a formal arrangement by two or more parties to manage and operate a business and share its profits. In this article, we will explore the different. It can take various forms,. The meaning of partnership is the state of being a partner : Learn how partnerships work and their advantages and disadvantages. A partnership is a formal arrangement by two or more parties to manage and operate a business and share its profits. In this article, we discuss what a partnership is, the different types, what to look for in a partner, partnership taxation and the steps you can follow to choose the right partner. There are several types of. In this article, we will explore the different aspects of. A partnership is a business arrangement where two or. How to use partnership in a sentence. Explore the legal framework of partnerships, including formation, liability, obligations, and dissolution processes. Each person contributes money, property, labor or skill, and shares in the profits and. Partnerships are one of the most popular options as they allow the pooling of resources and reduce the burden on a single individual.Chart of Accounts for Small Business Template Double Entry Bookkeeping

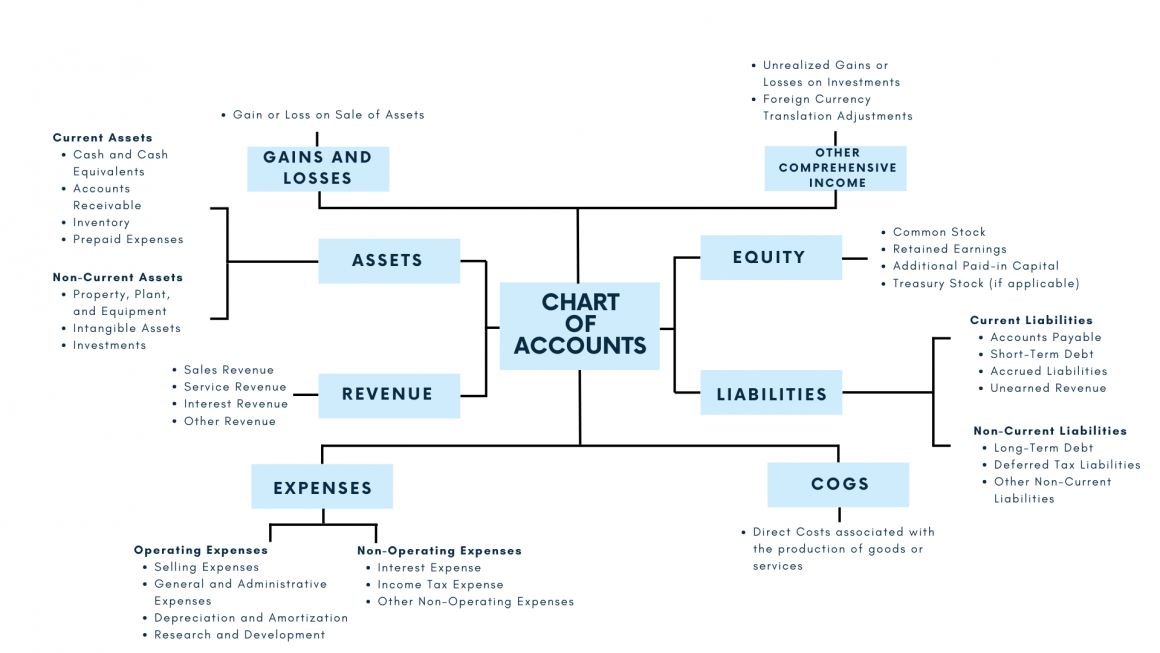

Chart Of Account

Product detail

Sample Chart of Accounts Template Double Entry Bookkeeping

Chart of Accounts Example A Sample Chart of Accounts (With Examples)

Chart of Accounts The Small Business Owner’s Guide to the COA (2022)

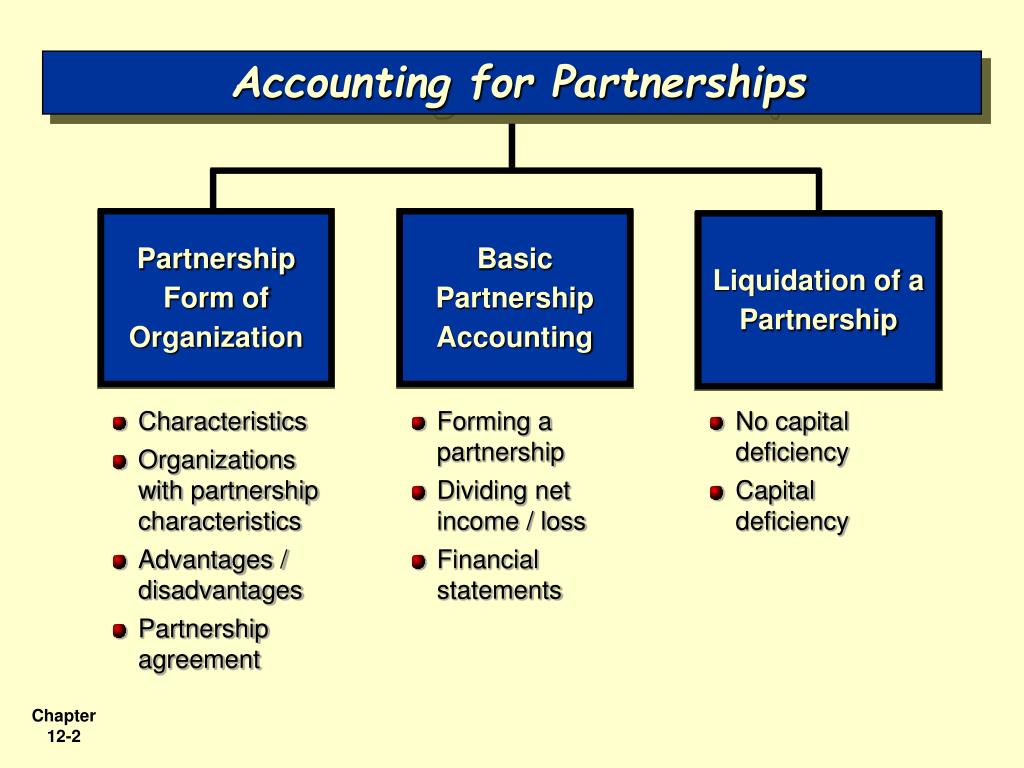

Accounting For Partnership Basic Concepts

What Is a Chart of Accounts? How to Get Started and More

Partnership & LLC Chart of Accounts Template Quickbooks Online and Xero Professionally Created

Basic Chart Of Accounts Structure

A Partnership Is The Simplest Business Structure For Companies With More Than One Owner.

A Partnership Is The Relationship Between Two Or More People To Do Trade Or Business.

A Partnership Is A Collaborative Relationship Between Two Or More Parties Aimed At Achieving Shared Goals Or Mutual Benefits.

According To Section 4 Of The Partnership Act Of 1932,Partnership Is Defined As The Relation Between Two Or More Persons Who Have Agreed To Share The Profits Of A Business Carried On.

Related Post:

:max_bytes(150000):strip_icc()/chart-accounts.asp_final-438b76f8e6e444dd8f4cd8736b0baa6a.png)