Accounting T Chart

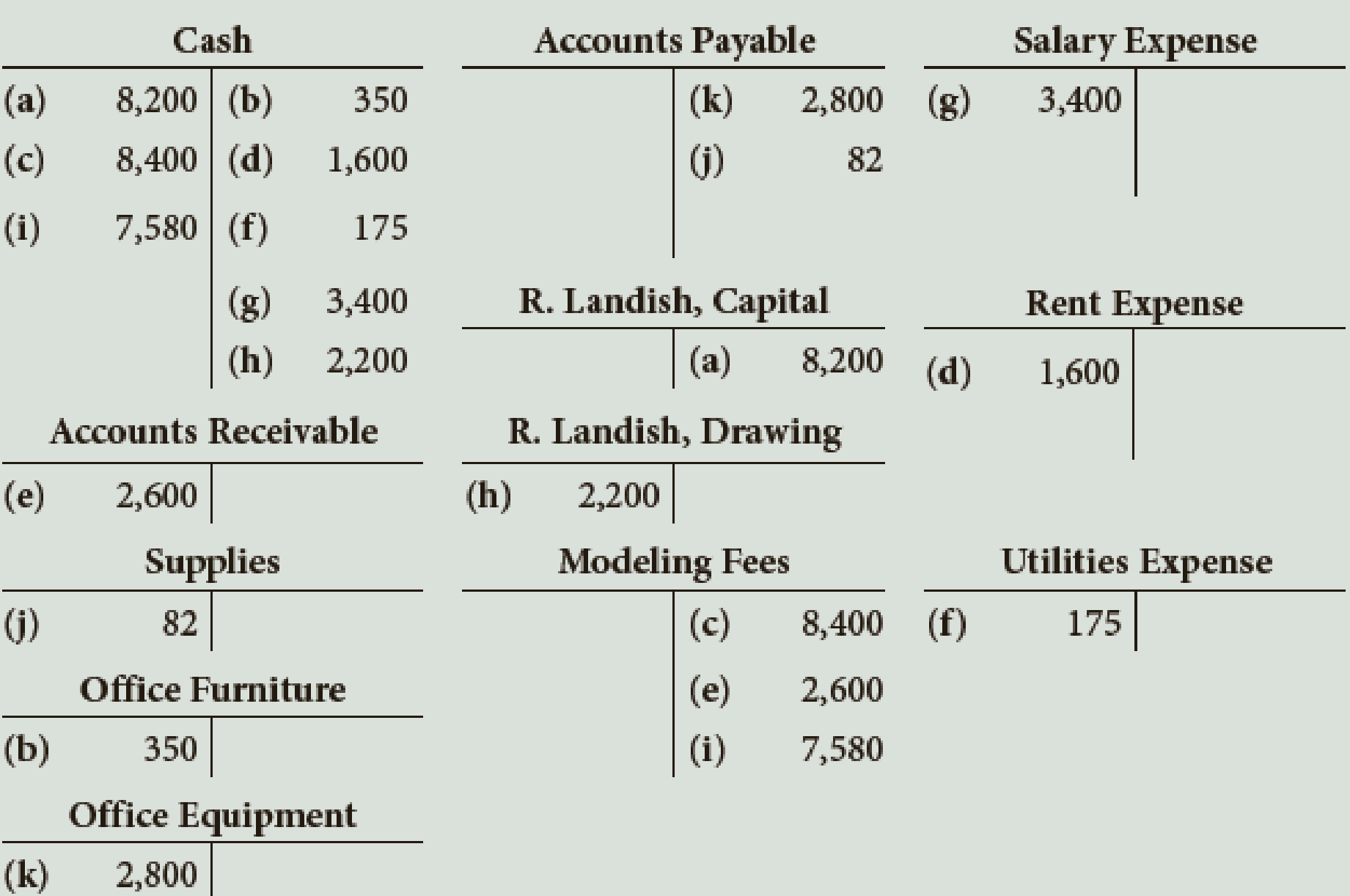

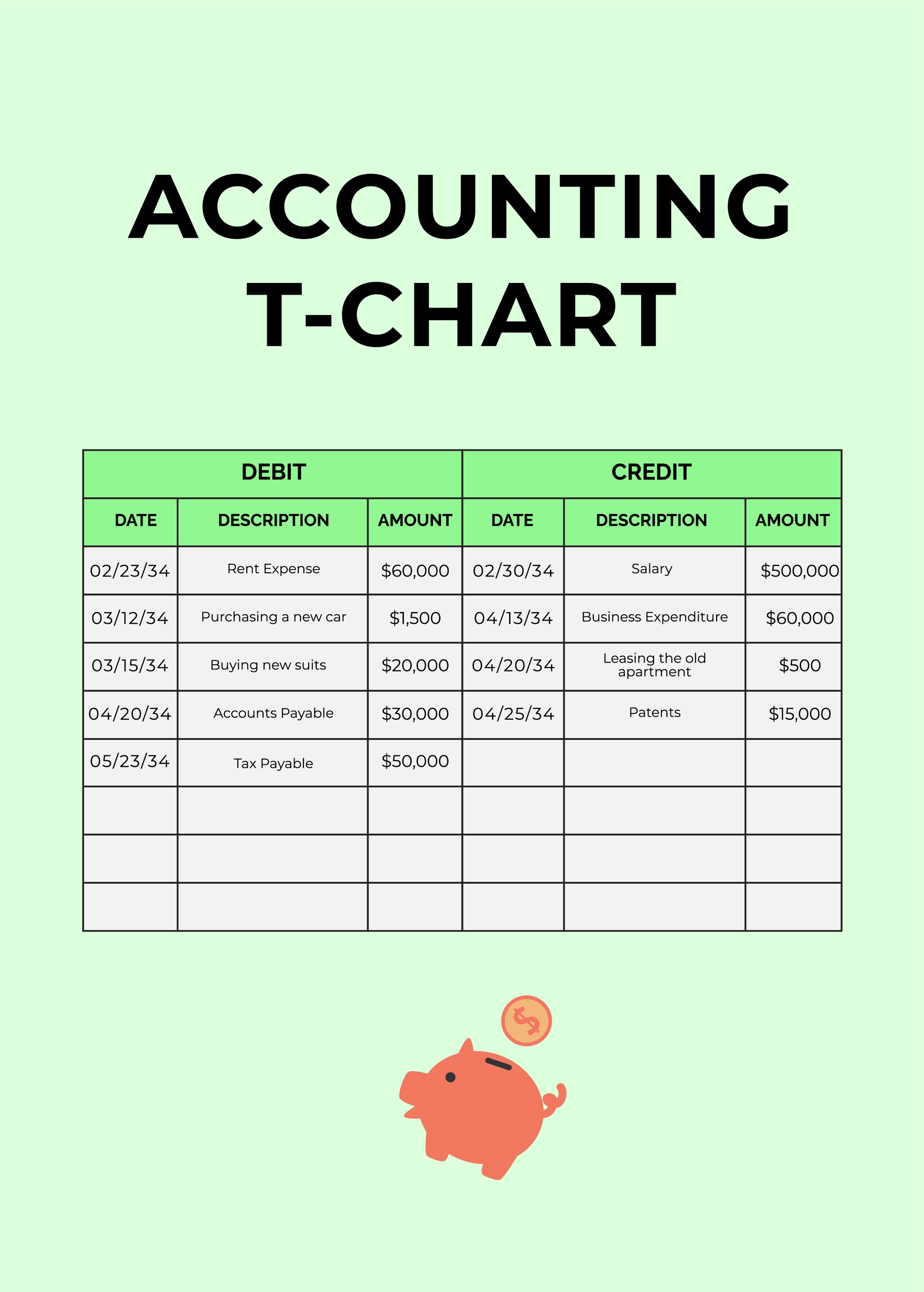

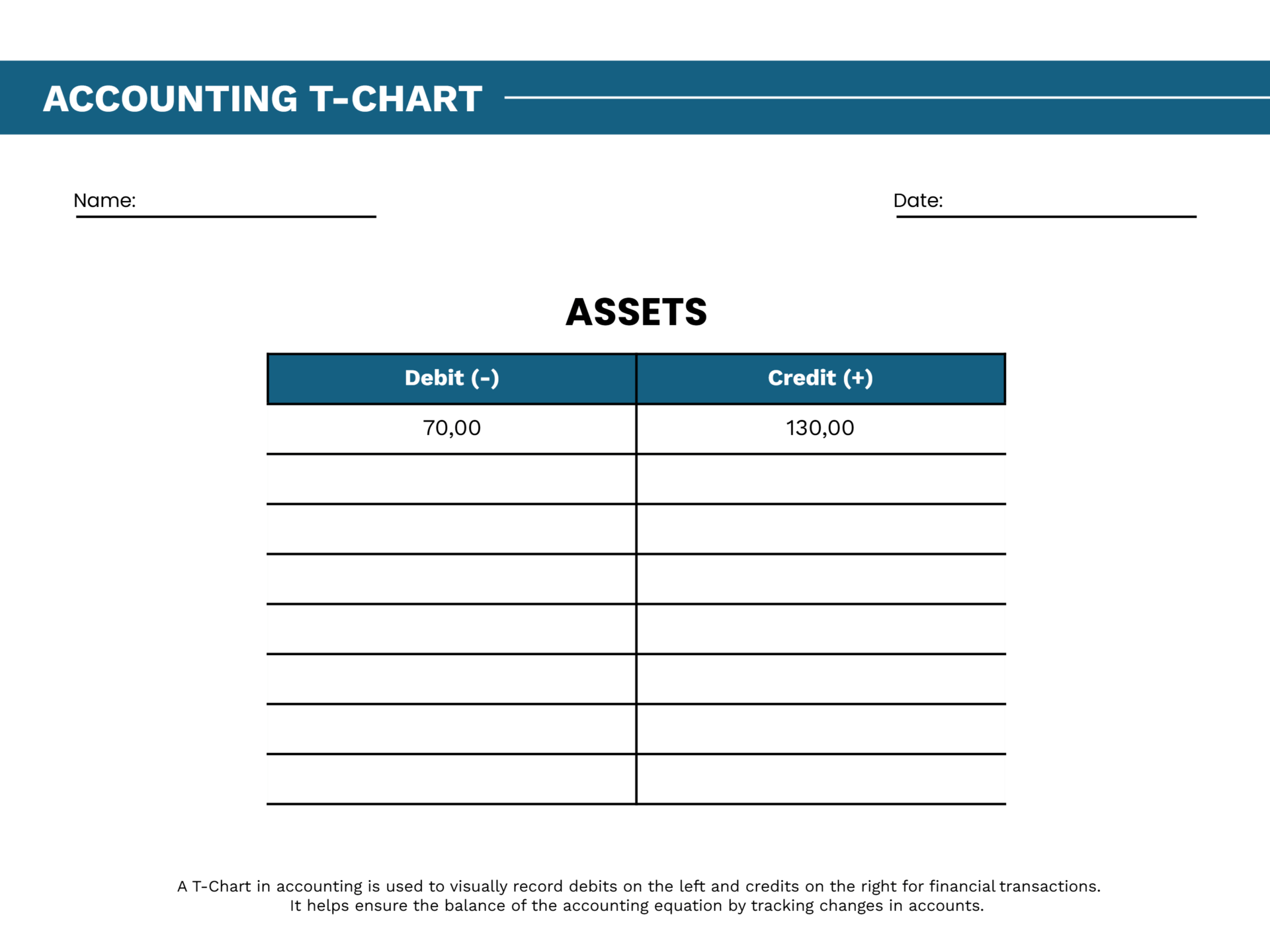

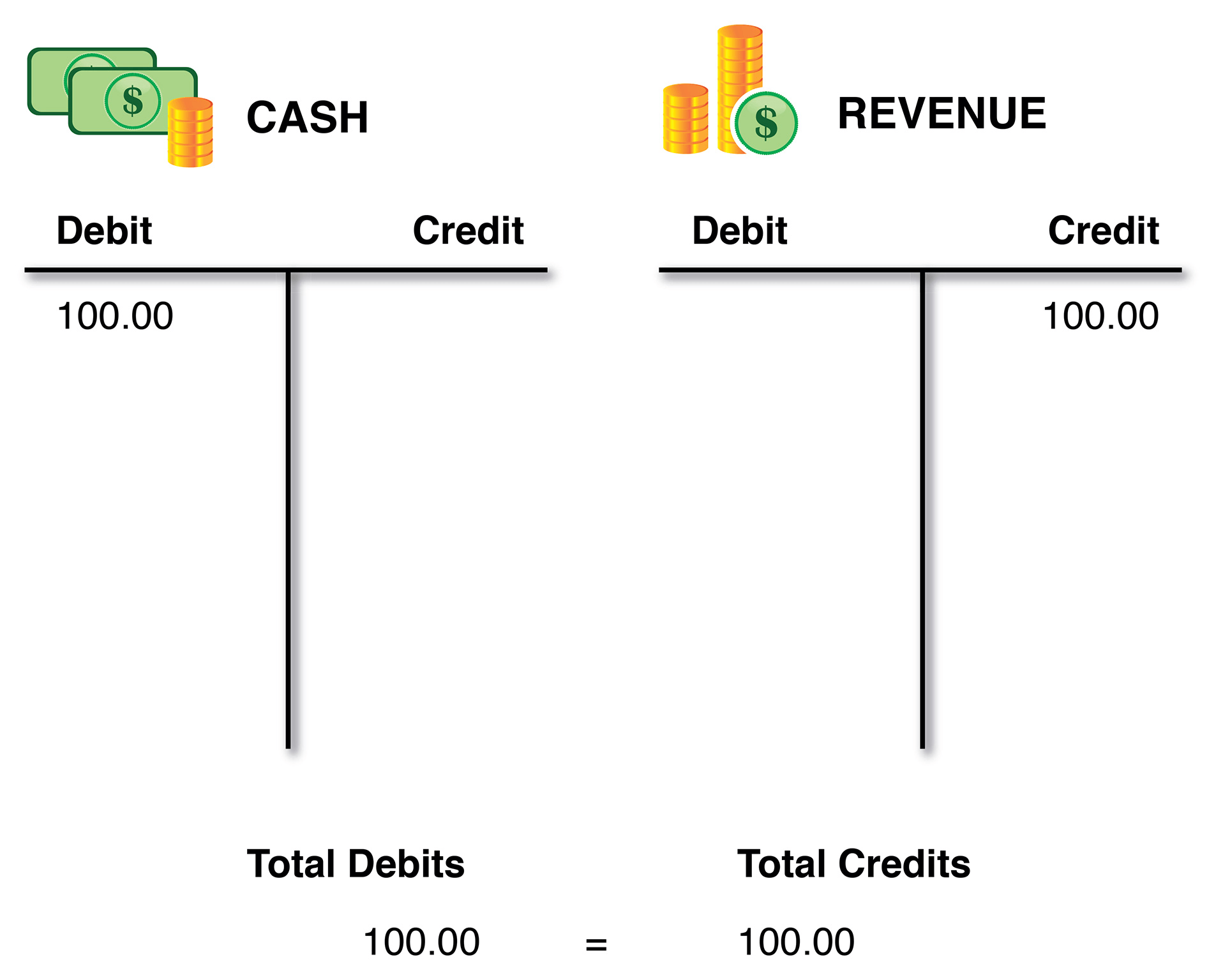

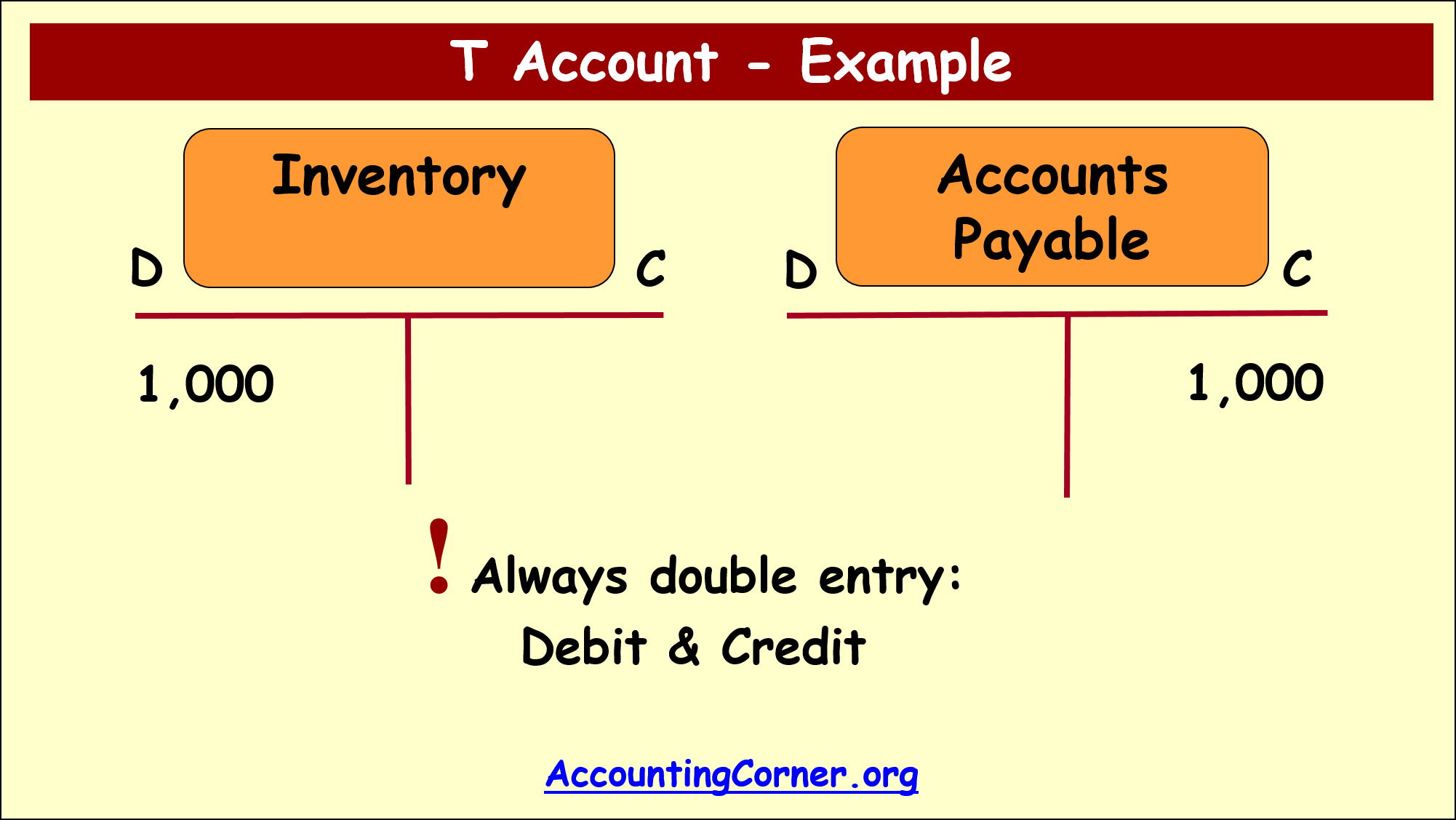

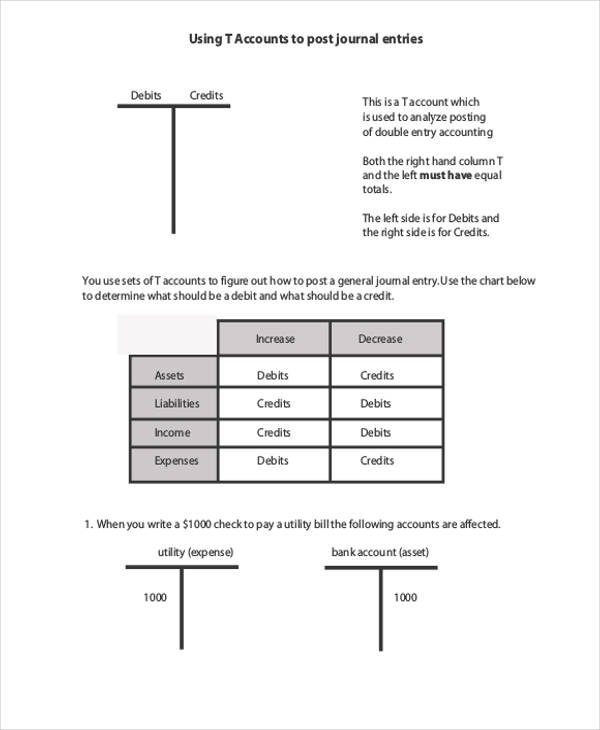

Accounting T Chart - The account is a running record of credits and debits,. Now, every business has its own chart of accounts that depends. The t account is a visual representation of individual accounts in the form of a “t,” making it so that all additions and subtractions (debits and credits) to the account can be easily tracked and. This list is referred to as the company’s. When a company’s accounting system is set up, the accounts most likely to be affected by the company’s transactions are identified and listed out. This t format graphically depicts the debits on the left side of the t and the credits on the right. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc. The t accounts themselves are not part of. To create and record a t account, you have to know how debit and credit rules apply to the different types of accounts. A t account is the visual structure used in double entry bookkeeping to keep debits and credits separated. The t accounts themselves are not part of. It is typically represented as two columns with the accounts that have been affected. T accounts are a useful bookkeeping tool used to visualize double entry bookkeeping journal entries before they are posted. When a company’s accounting system is set up, the accounts most likely to be affected by the company’s transactions are identified and listed out. This list is referred to as the company’s. To create and record a t account, you have to know how debit and credit rules apply to the different types of accounts. Now, every business has its own chart of accounts that depends. A t account is the visual structure used in double entry bookkeeping to keep debits and credits separated. This t format graphically depicts the debits on the left side of the t and the credits on the right. The account is a running record of credits and debits,. The t account is a visual representation of individual accounts in the form of a “t,” making it so that all additions and subtractions (debits and credits) to the account can be easily tracked and. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc. When a company’s accounting system is set up, the accounts. T accounts are a useful bookkeeping tool used to visualize double entry bookkeeping journal entries before they are posted. This list is referred to as the company’s. The t account is a visual representation of individual accounts in the form of a “t,” making it so that all additions and subtractions (debits and credits) to the account can be easily. It is typically represented as two columns with the accounts that have been affected. This t format graphically depicts the debits on the left side of the t and the credits on the right. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc. The account is a running record of credits and debits,. T. The t accounts themselves are not part of. In this lesson we're going to learn exactly what these are, we'll look at. T accounts are a useful bookkeeping tool used to visualize double entry bookkeeping journal entries before they are posted. This t format graphically depicts the debits on the left side of the t and the credits on the. When a company’s accounting system is set up, the accounts most likely to be affected by the company’s transactions are identified and listed out. It is typically represented as two columns with the accounts that have been affected. T accounts are a useful bookkeeping tool used to visualize double entry bookkeeping journal entries before they are posted. This t format. The account is a running record of credits and debits,. The t account is a visual representation of individual accounts in the form of a “t,” making it so that all additions and subtractions (debits and credits) to the account can be easily tracked and. In this lesson we're going to learn exactly what these are, we'll look at. It. T accounts are a useful bookkeeping tool used to visualize double entry bookkeeping journal entries before they are posted. It is typically represented as two columns with the accounts that have been affected. In this lesson we're going to learn exactly what these are, we'll look at. The account is a running record of credits and debits,. This t format. To create and record a t account, you have to know how debit and credit rules apply to the different types of accounts. It is typically represented as two columns with the accounts that have been affected. The t accounts themselves are not part of. T accounts are a useful bookkeeping tool used to visualize double entry bookkeeping journal entries. In this lesson we're going to learn exactly what these are, we'll look at. When a company’s accounting system is set up, the accounts most likely to be affected by the company’s transactions are identified and listed out. A t account is the visual structure used in double entry bookkeeping to keep debits and credits separated. This t format graphically. A t account is the visual structure used in double entry bookkeeping to keep debits and credits separated. T accounts are a useful bookkeeping tool used to visualize double entry bookkeeping journal entries before they are posted. The t account is a visual representation of individual accounts in the form of a “t,” making it so that all additions and. A t account is the visual structure used in double entry bookkeeping to keep debits and credits separated. This t format graphically depicts the debits on the left side of the t and the credits on the right. To create and record a t account, you have to know how debit and credit rules apply to the different types of accounts. Now, every business has its own chart of accounts that depends. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc. This list is referred to as the company’s. The account is a running record of credits and debits,. The t accounts themselves are not part of. When a company’s accounting system is set up, the accounts most likely to be affected by the company’s transactions are identified and listed out. In this lesson we're going to learn exactly what these are, we'll look at.Accounting T Chart Cheat Sheet vrogue.co

Accounting T Chart Accounting Terms

Cogs chart of accounts foptsport

Balance Sheet T Account Format at Eileen Towner blog

Farming Chart Of Accounts Templates

Accounting T Chart Template Google Slides PowerPoint Highfile

Accounting T Chart Template

Accounting T Account Examples

Taccounts Basics of Accounting & Information Processing

Blank T Chart Template

The T Account Is A Visual Representation Of Individual Accounts In The Form Of A “T,” Making It So That All Additions And Subtractions (Debits And Credits) To The Account Can Be Easily Tracked And.

T Accounts Are A Useful Bookkeeping Tool Used To Visualize Double Entry Bookkeeping Journal Entries Before They Are Posted.

It Is Typically Represented As Two Columns With The Accounts That Have Been Affected.

Related Post:

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)